Are you tired of watching your hard-earned capital dwindle due to poor risk management? Do drawdowns leave you feeling frustrated and disappointed? You're not alone. Many traders struggle with drawdowns, which occur when your trading account experiences a loss in value from its peak. But fear not - effective risk management strategies can help you survive and thrive through drawdowns.

Don’t Let Drawdowns Sink Your Trading Career: Tips and Strategies for Managing Risk

This article provides a comprehensive guide to risk management, helping you master drawdowns. By the end of the article, you'll have a thorough understanding of the following areas:

- What drawdowns are and why they matter

- The importance of setting drawdown rules to protect your capital

- How to calculate drawdowns as a percentage to keep track of your losses

- Setting drawdown rules to manage risk like a pro

- Effective risk management strategies for traders to survive and thrive through drawdowns

- Diversifying your portfolio as a powerful risk management tool

- Using stop-loss orders to protect your capital from losses

- Keeping a trading journal to learn from your mistakes and successes

- Building a solid risk management plan with essential elements to consider

As a trader, you know that the financial markets can be unpredictable. Even the most experienced traders face losses from time to time. However, the key to a successful trading career lies in how you manage those losses. That's where drawdowns come into play.

In this comprehensive guide, we'll equip you with the knowledge and strategies you need to master drawdowns and manage risk like a pro. So let's dive deep into this article and start turning your trading career around.

Understanding Drawdowns: What They Are and Why They Matter

Drawdowns are a measure of the decline in an investment's value from its peak to its lowest point. They are a natural part of trading but can be destructive if not managed well. As an essential metric for traders and investors, drawdowns measure the amount of risk taken in an investment. Understanding drawdowns is the first step to effective risk management and goes a long way in your trading career.

The Importance of Setting Drawdown Rules: Protecting Your Capital

Setting drawdown rules is one of the most important aspects of risk management. Drawdown rules are predetermined levels of loss that you're willing to tolerate before exiting trading or stopping trading altogether. By setting drawdown rules, you protect your capital and prevent further losses. It's crucial to stick to your drawdown rules, as deviating from them can lead to emotional trading and further losses.

How to Calculate Drawdowns in Percentage: Keeping Track of Your Losses

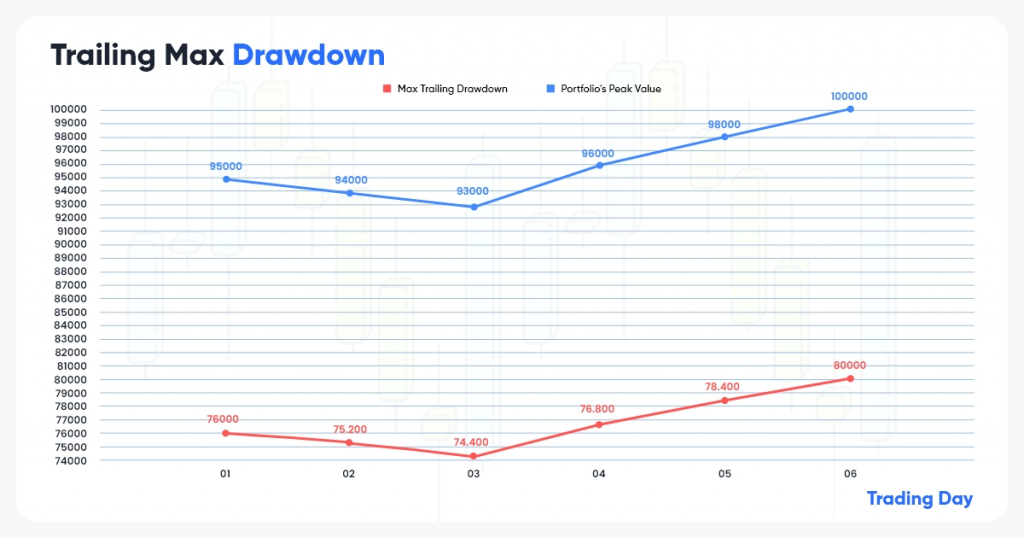

Calculating drawdowns in percentage is a key part of risk management, and it is relatively simple. To calculate drawdowns, you need to know the peak value of your portfolio or in other words, its high-water mark and its current value. The drawdown percentage is then calculated as the difference between the high-water mark and the current value, divided by the high-water mark.

For example, if your portfolio's peak value was $100,000, and the current value is $80,000, then your drawdown would be 20%, because $100,000 - $80,000 = $20,000, and $20,000/$100,000 = 20%.

Setting Drawdown Rules: How to Manage Risk Like a Pro

Setting drawdown rules is crucial to managing your risk as a trader. Drawdown rules help you determine the maximum allowable drawdown you are willing to take before making adjustments to your trading strategy or exiting the market altogether. For example, you may set a drawdown rule of 10%, meaning you will exit a trade, stop trading for a while, or adjust your trading strategy when your drawdown reaches 10%. As a rule of thumb for best practice when it comes to managing drawdowns, a good Max Drawdown rule could be set at 10%, while the Daily Drawdown limit can be set at 5%. If either of the drawdown rules is breached, it is advisable to pause your trading, reassess your strategy, and refine it as necessary before resuming. Note that the specific drawdown rules traders implement may vary depending on their individual risk tolerance.

Effective Risk Management Strategies for Traders: Surviving and Thriving Through Drawdowns

To survive and thrive through drawdowns, traders need to adopt risk management strategies. These include diversifying your portfolio, using stop-loss orders, avoiding emotional trading, and continuously monitoring your trades (set and forget). It's also important to have a long-term perspective and be patient. Successful traders understand that losses are a part of the game and that it's possible to recover from drawdowns with the right mindset and strategies.

Diversifying Your Portfolio: A Powerful Risk Management Tool

Diversification is a powerful risk management tool that can help reduce drawdowns in your trading portfolio. By spreading your investments across various asset classes and instruments, you can limit your exposure to any one particular market or asset, reducing the impact of any single market event on your overall portfolio.

Using Stop-Loss Orders: Protecting Your Capital from Losses

Stop-loss orders are a popular tool among traders for protecting their capital from losses automatically if the market moves against them. This way, you can limit your losses and manage your risk more effectively.

For example, let's say you are trading a CFD on a stock and you have bought it at $50 with the expectation that it will rise. However, if the stock's price suddenly drops to $45, triggering your stop-loss order at $48, you will automatically exit the trade with a loss of $2 per share. Without a stop-loss order in place, you would have incurred a greater loss as the price continued to drop.

By using stop-loss orders, you can minimize your risk exposure and protect your trading capital, allowing you to trade more confidently and with greater peace of mind.

Keeping a Trading Journal: Learning from Your Mistakes and Successes

A trading journal is an invaluable resource for improving your trading skills by reflecting on both your successes and failures. By recording your trades, analyzing your performance, and identifying areas for improvement, you can refine your trading strategy and risk management skills. Maintaining a trading journal allows you to learn from your experiences and make more informed decisions in the future.

Building a Solid Risk Management Plan: Essential Elements to Consider

It is important to emphasize that risk management is a critical aspect of successful trading. Without a solid risk management plan, traders may expose themselves to significant losses and potential account blowouts. Thus, it's important to carefully consider the following crucial elements when building a risk management plan:

- Define Your Trading Goals: Defining your trading goals and objectives is crucial before you begin your trading journey. It enables you to set a clear direction for your trading and determine the risk tolerance level you are willing to assume. Moreover, understanding your trading goals can help you identify the markets, instruments, or asset classes that align with your objectives.

- Assess Your Risk Tolerance Level: Risk tolerance refers to the level of risk that you're comfortable assuming. It is vital to assess your risk tolerance level to ensure that you're not taking on too much risk, especially more than you’re willing to lose. This will help you avoid making emotional or hasty trading decisions that can lead to significant losses.

- Diversify Your Portfolio: To minimize your risk exposures and prevent any single trade from impacting your overall portfolio, diversification is worth considering. This entails the distribution of your trading activity across various markets, instruments, or asset classes. By diversifying your portfolio, you can mitigate your risk and boost your odds of achieving long-term success.

- Determine Position Sizing: Position sizing refers to the amount of capital you allocate to each trade. It's important to determine the size of your positions based on your risk tolerance, market conditions, and trading strategy. This can help you manage your risk per trade, and overall exposure to avoid substantial losses.

- Set Drawdown Rules: Drawdowns are the percentage of your account balance that you're willing to risk on any given trade. It's vital to set drawdown rules to mitigate your losses and maintain discipline. By setting a drawdown limit, you can prevent significant losses and avoid impulsive trading decisions. To ensure compliance with drawdown rules and mitigate potential losses, it is essential to have a stop-loss in place for all your trades. Market volatility can be unpredictable, and without proper risk management measures, traders can easily veer off course. By setting a stop-loss order, you can automatically limit potential losses and protect your capital from significant drawdowns. This way, you can focus on executing your trading strategy without worrying about unpredictable market movements jeopardizing your account.

By considering these important elements, you can develop a comprehensive and in-depth risk management plan that can help you effectively manage your risk exposure, minimize your drawdown, and boost your chances of long-term success in trading. Remember, risk management is an ongoing process that requires constant monitoring and adjustments to ensure that you're sticking to your plan, staying within your risk tolerance level, and achieving your trading goals.

____________

In conclusion, managing risk is an essential component of achieving success in trading. To build a solid risk management plan, it's important to consider key elements such as defining your trading goals, assessing your risk tolerance, diversifying your portfolio, determining appropriate position sizes, and setting drawdown rules. With a comprehensive plan in place, you can better manage your risk exposure and increase your chances of achieving long-term success in trading.

FXPIG recognizes the significance of risk management in trading and is dedicated to equipping our clients with advanced tools and resources that enhance their trading journey. Our commitment to guaranteeing our clients' safety and success differentiates us from other brokers, and we aim to empower our clients to make informed trading decisions while minimizing risks.

How FXPIG Helps You Manage Risk

At FXPIG, we value the importance of risk management in achieving trading success, which is why we offer the following benefits to help our clients better manage risks:

- Trade with a True Multi-Asset Broker: Gain access to hundreds of products across 10+ asset classes, allowing our clients to diversify their portfolios and minimize their risk exposure.

- Flexible Leverage: We offer flexible leverage options of up to 500:1 to suit our clients’ trading styles and risk tolerance, empowering them to trade with confidence.

- True Institutional Pricing, No Markups: Enjoy Raw Spreads starting at 0.0 pips, reducing the odds of getting stopped out by spreads. Our pricing aggregators work with 20+ major Banks and Non-Bank LPs to get you the best prices available to save more with trading costs

- Advanced Risk Management Tools: Our trading platform includes advanced risk management tools from FXBlue, such as Mini Terminal, Market Manager, Alarm Manager, and more, to help our clients better manage risk exposure and protect their capital.