Economic Calendar

Monday- Bank Holidays for Australia, New Zealand, Switzerland, France, and Germany

Tuesday- Cash Rate for AUD

Thursday- EUR monetary policy statement

Friday- US CPI

Forex

EURUSD

EURUSD Daily Chart

EURUSD’s retracement momentum has slowly faded with a 50 daily moving average applying bearish pressure. 1.0800 is the next resistance level where most traders look for short opportunities. Additionally, bank holidays in major economies will remove a lot of liquidity from the market.

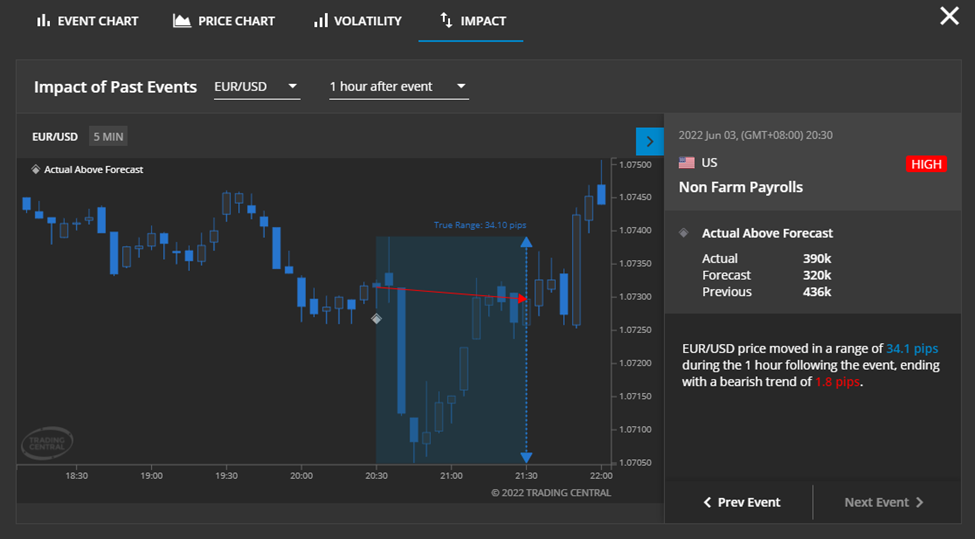

NFP last Friday was relatively slow, and Economic Insight from Trading Central provides key information in a sleek-looking illustration.

Trading Central: Economic Insight

From the chart, we can observe that EURUSD went down slightly and quickly bounced back up to end its one-hour movement just 1.8 pips below the opening price.

Precious Metals

Gold

XAUUSD Daily Chart

Most of the technical formation has not changed for gold since last Friday. Similar to EURUSD, we are expecting little movements on this metal today while everyone is getting set on US inflationary data. The broken trendline acts as immediate resistance while the 200 DMA supports gold from below.

Energies

Crude Oil

US Crude Daily Chart

Oil prices jumped last Friday to end the week at +4.57%. It could be attributed to the hike in crude price by Saudi Arabia starting with its July sales, at $6.50 premium. This move came after OPEC+ decided to accelerate their increase in output in the next months, which shows just how tight the current supply in the market is. We are definitely looking forward to crude oil hitting $129 previous highs if this continues.

US Stocks

SP500

SP500 Daily Chart

After bouncing off from the bearish trendline, SP500 managed to stay and trade above 4100. The 50 DMA is the first test for the bulls should the stock markets is to rebound from its 1-year-low. CPI remains the key event for the US stocks market so trade cautiously while the market is setting up for the event.

Cryptocurrencies

Bitcoin

BTCUSD Daily Chart

Market-leading Bitcoin has been stuck in the 30000 area for almost a month now. There was some buying taking place as we saw a 4.76% gain since today’s morning. Still no significant movement to signal any potential trending move. 34000 together with the 50 Daily moving average remain the next resistance while 30000 is a tough support level to break through.

Welf

Trader, Technical Analyst

________________________________________________________________________________________

Don’t miss out on BIG market moves!

Want to trade more than 300+ instruments with raw spreads starting from 0 pip and commissions as low as $2 per lot per side?

Sign up with FXPIG now!