| Symbol | LND | NY | Asia |

| AUDCAD | 1.19639 | 1.42698 | 1.20647 |

| CHFDKK | 3.27193 | 3.98573 | 3.86643 |

| AUDCHF | 1.14798 | 1.47658 | 1.16746 |

| AUDJPY | 0.71078 | 0.89349 | 0.6897 |

| AUDNOK | 5.39759 | 6.68561 | 7.77996 |

| AUDNZD | 1.86678 | 2.36156 | 1.7794 |

| AUDPLN | 22.57079 | 34.02993 | 41.21067 |

| AUDSEK | 4.98345 | 8.57485 | 7.60028 |

| AUDSGD | 5.01417 | 6.36078 | 4.23253 |

| AUDUSD | 0.25585 | 0.4133 | 0.2904 |

| CADCHF | 0.96879 | 1.33797 | 1.19721 |

| CADJPY | 1.36268 | 1.53566 | 1.4833 |

| CADPLN | 20.96858 | 33.30555 | 43.19805 |

| CADSGD | 4.12341 | 4.87651 | 3.61712 |

| CHFJPY | 1.67191 | 2.31527 | 1.7381 |

| CHFNOK | 58.9774 | 87.78075 | 107.42997 |

| CHFPLN | 35.94928 | 72.78981 | 77.39345 |

| CHFSEK | 53.56514 | 77.60775 | 113.73351 |

| CHFSGD | 4.84057 | 5.94164 | 4.30638 |

| CHFTRY | 325.40304 | 393.46111 | 502.48568 |

| DKKJPY | 1.72896 | 1.78118 | 1.86139 |

| EURAUD | 0.56029 | 0.72487 | 0.56279 |

| EURCAD | 1.77193 | 1.98723 | 1.91994 |

| EURCHF | 0.92462 | 1.69609 | 0.93664 |

| EURGBP | 0.61642 | 1.0139 | 1.01849 |

| EURHKD | 9.07774 | 13.82219 | 8.57316 |

| EURHUF | 31.77802 | 43.71601 | 57.01422 |

| EURJPY | 0.65126 | 1.05252 | 0.95549 |

| EURMXN | 5.91943 | 6.43713 | 6.74372 |

| EURNOK | 34.28612 | 64.87475 | 67.26241 |

| EURNZD | 2.51604 | 3.21045 | 3.33972 |

| EURPLN | 25.60434 | 45.98364 | 60.38776 |

| EURSEK | 39.79948 | 59.82007 | 78.38452 |

| EURSGD | 2.71933 | 3.50299 | 2.53021 |

| EURTRY | 77.57966 | 111.49146 | 217.7744 |

| EURUSD | 0.16966 | 0.2331 | 0.22407 |

| GBPAUD | 2.25955 | 3.00126 | 2.53734 |

| GBPCAD | 2.56351 | 3.1708 | 2.70587 |

| GBPCHF | 2.0235 | 2.58614 | 2.0915 |

| GBPDKK | 1.74848 | 2.1284 | 2.57113 |

| GBPJPY | 1.88502 | 2.44767 | 2.05236 |

| GBPNOK | 73.55181 | 107.30615 | 123.75031 |

| GBPNZD | 3.64314 | 4.53266 | 3.68068 |

| GBPPLN | 40.96334 | 76.66627 | 87.988 |

| GBPSEK | 39.11529 | 69.29267 | 66.55062 |

| GBPSGD | 4.3079 | 7.38442 | 3.78388 |

| GBPUSD | 0.28547 | 0.37462 | 0.50034 |

| GBPZAR | 10.22156 | 17.63954 | 16.78609 |

| HKDJPY | 0.6366 | 1.18932 | 0.60935 |

| JPYNOK | 4.49091 | 4.65792 | 4.75882 |

| MXNJPY | 1.79527 | 1.82567 | 2.00499 |

| NOKDKK | 8.75639 | 17.52086 | 20.07695 |

| NOKJPY | 1.75299 | 2.04672 | 2.25479 |

| NOKSEK | 9.52089 | 12.32286 | 15.14062 |

| NZDCAD | 0 | 0 | 0 |

| NZDCHF | 1.20397 | 1.56167 | 1.25138 |

| NZDJPY | 1.04973 | 1.28426 | 1.17307 |

| NZDSGD | 3.1135 | 3.71285 | 2.8938 |

| NZDUSD | 0.54854 | 0.71379 | 0.56077 |

| PLNJPY | 3.52635 | 6.18678 | 7.82206 |

| SEKJPY | 1.95546 | 2.20398 | 2.46502 |

| SEKNOK | 98.03037 | 144.30473 | 102.07923 |

| SGDJPY | 3.56397 | 4.52135 | 2.85073 |

| TRYJPY | 3.26047 | 3.47092 | 3.36632 |

| USDCAD | 0.37478 | 0.43504 | 0.53517 |

| USDCHF | 0.51682 | 0.72939 | 0.52099 |

| USDCNH | 13.28188 | 13.45451 | 12.17713 |

| USDCZK | 14.8379 | 18.7278 | 24.23106 |

| USDDKK | 7.15853 | 8.28318 | 8.91005 |

| USDHUF | 31.49583 | 40.08965 | 59.84616 |

| USDJPY | 0.25958 | 0.41805 | 0.28354 |

| USDMXN | 4.96361 | 5.10758 | 5.17276 |

| USDNOK | 35.41944 | 65.02662 | 62.59374 |

| USDPLN | 23.61911 | 37.90462 | 53.02413 |

| USDRUB | 0 | 0 | 0 |

| USDSEK | 34.92865 | 57.51124 | 67.74984 |

| USDSGD | 2.07497 | 2.95895 | 1.74564 |

| USDTRY | 52.10257 | 80.51126 | 176.54512 |

| USDZAR | 65.68293 | 118.79527 | 115.14861 |

| ZARJPY | 1.87043 | 2.14322 | 2.08805 |

| XAUEUR | 42.5546 | 46.93128 | 59.78941 |

| XAUUSD | 10.08629 | 12.2165 | 11.95719 |

| XPDUSD | 107.12118 | 152.26986 | 187.75763 |

| XPTUSD | 31.93306 | 36.71722 | 34.97113 |

| XAGEUR | 2.2095 | 2.64376 | 2.24913 |

| XAGUSD | 0.84974 | 0.89477 | 0.81482 |

| WTI_OIL | 9.69025 | 9.52623 | 10.77164 |

| UKOIL.c | 4.81296 | 4.8367 | 5.51869 |

| VIX.c | 1.79943 | 1.69383 | 1.89873 |

| AAPL.OQ | 0 | 0 | 0.5 |

| ADSGn.DE | 0.85733 | 0.7565 | 1.2 |

| AIG.N | 0 | 0 | 0.5 |

| AIRF.PA | 0.54403 | 0.57388 | 0.5 |

| ALVG.DE | 1.13015 | 1.0725 | 1.4 |

| AMZN.OQ | 0 | 0 | 0.5 |

| AXP.N | 0 | 0 | 1.3 |

| BA.N | 0 | 0 | 1.4 |

| BAC.N | 0 | 0 | 0.5 |

| BABA.N | 0 | 0 | 1.2 |

| BAYGn.DE | 0.5693 | 0.54652 | 0.8 |

| BBVA.MC | 0 | 0 | 0 |

| BMWG.DE | 0.60393 | 0.56359 | 0.8 |

| BNPP.PA | 0.561 | 0.54346 | 0.6 |

| CSCO.OQ | 0 | 0 | 0.6 |

| CVX.N | 0 | 0 | 2.3 |

| DAIGn.DE | 0.57723 | 0.54786 | 0.6 |

| DANO.PA | 0.58853 | 0.55837 | 0.6 |

| DBKGn.DE | 0.54711 | 0.54187 | 0.6 |

| DPWGn.DE | 0.55328 | 0.54353 | 0.6 |

| EBAY.OQ | 0 | 0 | 0.5 |

| EONGn.DE | 0.5512 | 0.54686 | 0.5 |

| FB.OQ | 0 | 0 | 1 |

| FDX.N | 0 | 0 | 2.1 |

| GE.N | 0 | 0 | 1 |

| GM.N | 0 | 0 | 0.5 |

| GOOG.OQ | 0 | 0 | 0.6 |

| GS.N | 0 | 0 | 3.1 |

| HLT.N | 0 | 0 | 1.9 |

| HPQ.N | 0 | 0 | 0.6 |

| IBE.MC | 0.54271 | 0.53536 | 0.6 |

| IBM.N | 0 | 0 | 1 |

| ILMN.OQ | 0 | 0 | 2 |

| INTC.OQ | 0 | 0 | 0.5 |

| JNJ.N | 0 | 0 | 5.4 |

| JPM.N | 0 | 0 | 0.8 |

| KO.N | 0 | 0 | 0.5 |

| LHAG.DE | 0.54578 | 0.53996 | 0.5 |

| LVMH.PA | 2.0773 | 1.90042 | 2.4 |

| MA.N | 0 | 0 | 12.8 |

| MAP.MC | 0.55304 | 0.53333 | 0.5 |

| MCD.N | 0 | 0 | 1.6 |

| NFLX.OQ | 0 | 0 | 2.5 |

| MSFT.OQ | 0 | 0 | 1.4 |

| ORCL.N | 0 | 0 | 0.7 |

| PFE.N | 0 | 0 | 0.6 |

| PG.N | 0 | 0 | 1.8 |

| QCOM.OQ | 0 | 0 | 1 |

| RACE.N | 0 | 0 | 14.1 |

| SAN.MC | 0.74864 | 0.74733 | 0.7 |

| SIEGn.DE | 0.74912 | 0.70332 | 0.8 |

| SOGN.PA | 0.55176 | 0.54438 | 0.6 |

| T.N | 0 | 0 | 0.5 |

| TEF.MC | 0.5472 | 0.53989 | 0.5 |

| TEVA.P | 0 | 0 | 0.5 |

| TOTF.PA | 0.56698 | 0.55183 | 0.6 |

| TSLA.OQ | 0 | 0 | 1.6 |

| TWTR.N | 0 | 0 | 0 |

| V.N | 0 | 0 | 2.5 |

| XOM.N | 0 | 0 | 0.7 |

| VOWG_p.DE | 0.80552 | 0.70915 | 0.8 |

| C.N | 0 | 0 | 0.6 |

| CBKG.DE | 0.54434 | 0.54326 | 0.5 |

| F.N | 0.52557 | 0.52288 | 0.5 |

| CGC.N | 0.53067 | 0.53056 | 0.5 |

| CRON.OQ | 0.52301 | 0.52904 | 0.5 |

| UBER.N | 0.56841 | 0.54581 | 0.5 |

| USOIL.f | 0.54417 | 0.54696 | 0.54999 |

| IND50.v | 130.01861 | 130 | 116.40741 |

| AUS200.v | 34 | 35.09688 | 40.14778 |

| DE30.v | 16.03279 | 17.23301 | 32.1132 |

| DJ30.v | 27.43661 | 25.46937 | 28.00084 |

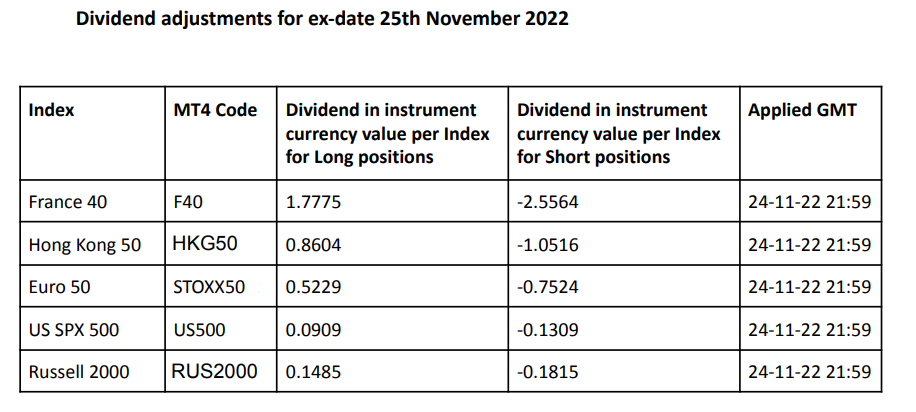

| F40.v | 19.00698 | 19.70758 | 73.98379 |

| HKG50.v | 89.8936 | 76.07345 | 122.34735 |

| IND50.v | 130.01861 | 130 | 116.40741 |

| JPN225.v | 908.15119 | 908 | 1002.2654 |

| STOXX50.v | 29 | 29.58464 | 30.69051 |

| UK100.v | 19.0081 | 19.92298 | 36.31185 |

| US500.v | 12.60071 | 12.69847 | 12.60034 |

| USTEC.v | 23.01159 | 23.78195 | 23.00528 |

| SHIUSDT | 0.00001 | 0.00001 | 0.00001 |

| ADAUSDT | 0.001 | 0.001 | 0.001 |

| ALGOUSDT | 0.001 | 0.001 | 0.001 |

| ATOMUSDT | 0.01016 | 0.01016 | 0.01019 |

| AVAXUSDT | 0.0105 | 0.01053 | 0.01057 |

| BCHUSDT | 0.11035 | 0.10684 | 0.10733 |

| BNBUSDT | 0.102 | 0.10201 | 0.10294 |

| BTCUSDT | 1.00797 | 1.00775 | 1.01045 |

| DASHUSDT | 0.10963 | 0.11016 | 0.1151 |

| DOGEUSDT | 0.0001 | 0.0001 | 0.0001 |

| DOTUSDT | 0.01002 | 0.01002 | 0.01003 |

| ETHUSDT | 0.10138 | 0.10167 | 0.10256 |

| LINKUSDT | 0.01005 | 0.01004 | 0.01004 |

| LUNAUSDT | 0 | 0 | 0 |

| OMGUSDT | 0.01009 | 0.01002 | 0.01006 |

| ONEUSDT | 0.0001 | 0.0001 | 0.0001 |

| SOLUSDT | 0.0103 | 0.01036 | 0.01059 |

| TRXUSDT | 0.0001 | 0.0001 | 0.0001 |

| XRPUSDT | 0.001 | 0.001 | 0.001 |

| US2000.v | 4.00318 | 4 | 5.60061 |