Have you ever felt discouraged after significant drawdowns in your trading account, leading to questioning your skills and losing confidence? Trading can be an emotional rollercoaster, but it’s important to remember that losses don’t define you. Even the most skilled traders in the industry have experienced setbacks. Embrace drawdowns as an opportunity to learn and grow in your trading career.

But how can you stay motivated in the face of challenges, especially when experiencing drawdowns? Here are some tips to help you maintain a positive mindset and continue on the path to success:

- Set realistic goals

- Don’t compare yourself to others

- Review your trades

- Take a break if you need to

- Learn from your mistakes

Developing the right mindset is crucial for achieving your trading objectives and creating a successful career in trading. In this article, we’ll provide valuable insights on how to stay motivated and maintain level-headedness even when facing drawdowns. By implementing these strategies, you can cultivate a positive and resilient mindset that will help you overcome obstacles and achieve long-term success in trading.

Discover More Tips for Managing Drawdowns

Start setting realistic goals that you can achieve over time

Setting realistic goals is essential for success in trading. Social media and internet influencers often paint a misleading picture of trading, suggesting that it’s easy to achieve life-changing outcomes with a click of a button. In reality, trading requires a great deal of patience, perseverance, skill, and hard work to reach that level of success. It’s important to understand that trading is a process-oriented activity, and your goals should reflect that.

To set achievable goals, you need to assess your current trading skills and capabilities. Start by setting small, attainable goals that you can achieve over time. This will give you a sense of satisfaction and motivation to keep pushing forward. As you progress in your trading career, you can adjust your goals and set more challenging targets. Remember, success in trading is a journey, not a destination. By setting realistic goals, you can build a strong foundation for long-term success.

Stop comparing yourself to others

It’s unproductive to compare yourself to other traders as this will only discourage you. You can never determine your progress by comparing yourself to others. Success in trading is subjective and differs from one trader to another. The only effective way to measure your success is by comparing your current self to your past self. Evaluating your progress and acknowledging how far you’ve come over the months or years can be incredibly empowering and fuel your long-term success.

Review your trades and identify areas for improvement

Reviewing and analyzing your trades is crucial, as it presents an opportunity to learn from your mistakes and identify areas for improvement. This helps you refine and develop your trading strategy accordingly, which is key to your trading success. Successful traders are always on the lookout for commonalities and patterns of their losses to identify areas where it all went wrong, such as their risk management, the judgment of market conditions, the technical analysis, or a deviation from their trading plan. Analyzing these data points will help minimize your risk and mistakes, and improve your overall trading performance in the future.

Check out some of our effective tips for improving your trading skills

Learn from your mistakes

Making mistakes in trading is inevitable, we all make them, but they are not failures, as they present opportunities to learn and grow. Analyzing your losses can be a crucial step in improving your skills and refining your trading strategy. By reflecting on your mistakes, you can identify patterns and pinpoint areas to improve, allowing you to minimize your risk in the future. Remember that trading is a journey, and every mistake is a valuable lesson that can lead to greater success. So, instead of beating yourself up over your losses, use them as a stepping stone to a more profitable and fulfilling trading career.

Take a break if needed

It’s important to prioritize your mental and emotional well-being as a trader. Feeling overwhelmed or stressed is a normal part of the journey, but it’s essential to recognize when you need to take a break. Taking a step back from the charts for a little while can help you gain clarity and perspective, so you can come back refreshed and ready to tackle the markets. Remember, trading is not a sprint, and your well-being is just as important as developing your trading skills. By prioritizing your well-being, you can approach trading with a clearer mind and make better decisions.

Learn how to make better-informed decisions in trading

Maintaining motivation in trading can be a challenging task, especially when facing setbacks and drawdowns. However, by setting realistic goals, avoiding comparisons with others, reviewing trades, learning from mistakes, and prioritizing mental and emotional well-being, traders can develop a positive and resilient mindset. Remember that trading is a journey, and every setback is an opportunity to learn and grow. With a clear mindset, perseverance, and dedication, traders can achieve long-term success in the markets.

FXPIG recognizes the significance of risk management in trading and is dedicated to equipping our clients with advanced tools and resources that enhance their trading journey. Our commitment to guaranteeing our clients’ safety and success differentiates us from other brokers, and we aim to empower our clients to make informed trading decisions while minimizing risks.

How FXPIG Helps You Manage Risk

At FXPIG, we value the importance of risk management in achieving trading success, which is why we offer the following benefits to help our clients better manage risks:

- Trade with a True Multi-Asset Broker: Gain access to hundreds of products across 10+ asset classes, allowing our clients to diversify their portfolios and minimize their risk exposure.

- Flexible Leverage: We offer flexible leverage options of up to 500:1 to suit our clients’ trading styles and risk tolerance, empowering them to trade with confidence.

- True Institutional Pricing, No Markups: Enjoy Raw Spreads starting at 0.0 pips, with true institutional pricing and no markups. Our pricing aggregators work with 20+ major Banks and Non-Bank LPs to get you the best prices available to save more with trading costs

- Advanced Risk Management Tools: Our trading platform includes advanced risk management tools from FXBlue, such as Mini Terminal, Market Manager, Alarm Manager, and more, to help our clients better manage risk exposure and protect their capital.

Achieving consistent profitability as a trader is no easy feat. It’s the ultimate goal for every trader, and there is no better feeling when you’ve finally achieved it. Becoming a consistently profitable trader takes a lot of hard work and dedication. It takes a combination of skills, knowledge, discipline, and the right mindset.

Trading is not for everyone, but if you’re serious about becoming a consistently profitable trader, you’ve come to the right place. In this article, we will dive deep into the key factors of what it takes to achieve consistency and success in your trading career. We will be providing you with actionable tips that can help you achieve your trading goals and fuel your growth to become the trader you were meant to be.

Without further ado, let’s get started!

1. Knowledge and Skills

You need a profound comprehension of trading the markets and strategies that work best with your trading style. This would involve developing your knowledge and skills in technical analysis, fundamental analysis, risk management, and trading psychology. These are the key drivers that would help build your trading confidence and fuel your success.

- Technical Analysis and Fundamental Analysis: This involves studying charts and using indicators or tools to identify potential trading opportunities from the understanding of price action, volume, and key levels. Fundamental analysis involves analyzing economic and market data to assess the underlying value of an asset.

- Risk Management: This is essential to protect your capital and involves setting stop-loss orders and determining the appropriate position size.

- Trading Psychology: This involves understanding the emotional aspects of trading, such as fear and greed, and developing a mindset that allows you to make rational trading decisions

*Gain an edge in the market and make better-informed trading decisions with our in-depth market analysis & research from industry experts

2. Discipline

In trading, discipline is the key to success. It means sticking to your trading plan consistently, following predetermined rules for trade entries and exits, and avoiding impulsive decisions. Developing discipline requires a clear understanding of your trading goals and strategies. You need a trading plan that outlines your rules for trade entries and exits, your risk management strategy, and your goals.

To stay disciplined, you need to avoid emotional trading decisions. This can be achieved by having a system in place to manage your emotions. For example, taking breaks or stepping away from the charts when you feel overwhelmed, or using positive affirmations to stay focused. By maintaining discipline, you increase your chances of success in trading.

*Discover more tips and tricks to become a better trader

3. Emotional Control

Truly successful traders have mastered the art of emotional management, avoiding the pitfalls of fear, greed, and other emotions that can cloud their decision-making abilities. To do the same, you must first understand your emotional triggers and develop strategies to overcome them. For example, if you begin to feel anxious about a trade, it may be helpful to take a step back or utilize relaxation techniques to regain a sense of calm.

Equally important is the cultivation of a positive mindset. Instead of fixating solely on trading outcomes, successful traders concentrate on the trading process and view losses as an opportunity for learning and growth. By adopting this mindset, you can significantly reduce the impact of negative emotions on your trading decisions and ultimately increase your chances of success.

*Learn more practical tips for managing emotions in trading

4. Adaptability

The markets are constantly changing, and the ability to adapt to changing market conditions is key to staying profitable. This includes being willing to adjust your trading strategies and risk management techniques as needed. To stay adaptable, you need to be aware of market trends, and news, and be open to new ideas and strategies.

One way to stay adaptable is to keep a trading journal. This will allow you to track your performance and identify areas where you need to make changes. You can also backtest your trading strategies to see how they perform under different market conditions.

*Stay ahead with market trends, changes, and insights from industry experts

5. Patience and Perseverance

Developing your trading knowledge, skills, and discipline is not an overnight success. It takes time and dedication to achieve a certain level of expertise. You need to establish realistic expectations of your progress to stay committed to your goals over the long term. Patience and perseverance are qualities that will help you weather the ups and downs of the market and ultimately lead to trading success.

Focus on the process of trading rather than the outcome. Setting achievable goals, and celebrating small wins along the way helps in building trading confidence which contributes significantly to your long-term trading success. You should also be prepared for setbacks and losses, and have a plan in place for dealing with them, as these parts are inherent in a trader, no matter the level of expertise.

6. Continuous Learning

Successful traders are lifelong learners who are always up-to-date with the latest market trends to continuously improve their skills and strategies. One way to continue learning is by reading trading books, attending webinars and seminars, and watching educational videos. These resources can help you gain new insights and ideas for trading strategies.

You can also benefit from following industry experts and successful traders on social media and other online platforms. This can give you access to their experiences and help you learn from their insights, tips, and strategies.

In addition to external resources, analyzing your own trading performance is vital to identify areas for improvement. Keeping a trading journal allows you to review your trades, identify patterns, and track your progress over time. By consistently evaluating your performance and seeking out new knowledge, you can continually refine your trading skills and stay ahead of the competition.

_________

Embarking on the path to becoming a consistently profitable trader is not easy. It’s a journey filled with challenges, but also rewarding opportunities. By utilizing the valuable tips provided in this article, you can sharpen your trading skills and enhance your chances of achieving lasting success. Always keep in mind that trading is an ongoing process, and the secret to achieving success is to remain steadfast in your goals, continually educate yourself, and remain flexible enough to adapt to the ever-changing market conditions.

At FXPIG, We Prioritize Our Clients’ Success

We understand what it takes to be consistently profitable in trading, and we’re committed to providing our clients with the tools and resources they need to succeed. Here are some of the reasons why traders worldwide choose FXPIG for their trading success:

- Safety and Security: We prioritize the safety and security of our client’s funds and use advanced technology and processes to ensure that their trading experience is as secure as possible.

- Trading Flexibility: We offer a wide range of trading instruments and platforms to suit traders of all levels and styles, including Forex, CFDs, Stocks, Precious Metals, and more

- Low Trading Costs: We offer Raw Spreads starting at 0.0 pips, low commissions, and we don’t charge any deposit and withdrawal fees.

- Innovative Tools and Resources: We provide our clients with access to a range of innovative trading tools and resources, including market analysis, educational materials, and more from FXBlue and Trading Central

- Exceptional Customer Support: Our team of experienced and knowledgeable support staff is available 24/5 to help our clients with any questions or issues.

Ready to start trading with a broker that puts you first?

Open an account with FXPIG today and experience the difference for yourself.

10 Effective Tips for More Profitable Trading

Are you new to trading and struggling to make consistent profits? Or are you an experienced trader looking to improve your skills? Regardless of your level of expertise, improving your trading skills is essential to succeed in the financial markets. Here are 10 basic but effective tips to help you improve your trading:

Tip #1 – Develop a Trading Plan

To succeed in trading, it’s crucial to have a well-defined trading plan. A trading plan outlines your trading strategy, risk management approach, and financial objectives, serving as a roadmap for your trading journey. By having a solid plan in place, you can effectively manage your emotions and remain focused on achieving your goals.

Tip #2 – Practice With a Demo Account

Before you start trading with real money, practicing with a demo account is a good idea. This will help you get familiar with the trading platform, test your strategies, and gain confidence without risking your capital.

Some important things to keep in mind while trading on a demo account:

- When trading on a demo account, you are using simulated market conditions, which can differ from a live trading environment due to the absence of slippage and order-fill limitations.

- Although demo trading is an effective way to begin, practice, and become acquainted with trading, it’s advisable to transition to trading the live market soon after. This is because the live market offers a more profound educational experience in terms of the market, mindset, skills, and gives you a genuine sense of trading.

Tip #3 – Start Small to Manage Your Risks

Starting with a modest capital amount is essential to manage your risks, especially if you’re just getting started. This can help you avoid potential problems that may arise from investing too much too soon. It’s important to only invest an amount that you can afford to lose and to use stop-loss orders to limit your losses.

Tip #4 – Keep a Trading Journal

Keeping a journal of your trades is a valuable practice that can aid in tracking your progress, analyzing your strengths and weaknesses, and improving your trading skills over time.

Tip #5 – Learn From Your Mistakes

Making mistakes is a part of the learning process. Instead of getting discouraged, use your mistakes as an opportunity to learn and improve your trading skills.

Tip #6 – Follow the News

Stay ahead of the curve by keeping yourself informed about the latest economic and political developments. By keeping an eye on news that can impact the markets you trade, especially those with high impact, you can make informed decisions and improve your trading results.

Check out FXPIG’s free Economic Calendar, powered by Trading Central. Click here to access it now!

Tip #7 – Use Technical Analysis

Utilizing technical analysis can assist you in identifying market trends, pinpointing support, and resistance levels, and identifying potential entry and exit points. Acquiring knowledge of technical analysis tools can enhance your trading skills and decision-making capabilities.

Click here to view the different technical tools provided by FXBlue. Free for all FXPIG Clients!

Tip #8 – Be Patient

Patience and discipline are essential virtues in trading. Resist the temptation to jump into trades without proper analysis, and exercise patience while waiting for the right market conditions to present themselves. This approach can help you make more informed and rational trading decisions while minimizing the risk of impulsive and emotional trades. Remember, successful traders don’t feel the need to be constantly in the market; they patiently wait for the right moment to strike.

Tip #9 – Keep Your Emotions in Check

Managing your emotions is key to successful trading. Fear and greed can cloud your judgment, leading to impulsive and costly decisions. Stay level-headed and composed under pressure to avoid making hasty choices that can negatively impact your trades.

Tip #10 – Continuously Educate Yourself

Stay ahead in the ever-changing financial markets by continuously learning and adapting. Attend webinars, read books, and follow expert traders to expand your knowledge and refine your trading skills.

Applying these straightforward yet potent tips can significantly enhance your trading skills and increase your probability of success in the financial markets. However, it’s important to remember that trading is a marathon, not a sprint, and overnight success is unlikely. To become a successful trader, you must invest time, effort, and patience, while continuously learning and adapting to market changes.

Why trade with FXPIG?

- Get True Institutional Pricing, No Markups: Enjoy Raw Spreads starting at 0.0 pips. Our pricing aggregators work with 20+ major Banks and Non-Bank LPs to get you the best prices available.

- Execute Trades Lightning Fast with 100% STP Execution: With 100% Straight-Through Processing (STP) execution, your orders go directly to the market without passing through a dealing desk. This means the fastest trade execution and the best prices for you.

- Trade with a True Multi-Asset Broker: Gain access to hundreds of products across 10+ asset classes with true institutional pricing, and Raw Spreads starting at 0.0 pips.

- Exceptional Customer Support: Have your queries answered fast with our dedicated support team of professionals available 24/5. Contact us via live chat, email, or WhatsApp and get the help you need.

What is the FOMC?

FOMC stands for Federal Open Market Committee, a branch of the Federal Reserve System

Who is on the committee?

– President of the Federal Reserve Bank of New York

– 7 members of the Board of Governors

– 4 Reserve Bank Presidents on a rotating basis

Why do they meet?

The members meet to discuss national and global economic developments and their stance on monetary policies

When are the meetings held?

FOMC meets 8 times per year, every 6 weeks. They can meet more often should the need arises.

Can we spectate the meeting?

FOMC meetings are held in private. However, the minutes will be released 3 weeks after the meetings. You can find them here.

What are their tools?

– Open Market Operations (the buying and selling of securities in the open market by a central bank)

– Adjusting interest rates

– Determining reserve requirements

How can those tools be used?

For expansionary monetary policies

Open Market Operations

Buying more bonds in the open markets

Interest Rate

Lowering the rate when lending money to commercial banks

Reserve Requirements

Decreasing the amount of money that financial institutions have to keep at the reserve bank

All of the above actions will lead to more money flowing into the economy and thus stimulate economic activities

(The opposite is true for contractionary monetary policies)

Precautions

FOMC meetings are among the most highly-anticipated events since the financial implications are widespread. Thus, market volatility usually increases around these times.

________________________________________________________________________________________________________________

Want to trade more than 300+ instruments with raw spreads starting from 0 pip and commissions as low as $2 per lot per side?

Sign up with FXPIG now!

What is CPI?

CPI stands for Consumer Price Index

What is it for?

CPI examines the weighted average of prices of a bundle of consumer goods and services

It serves as an economic indicator that measures the inflation/ deflation faced by end-user & determining the purchasing power of the dollar

What is included in the bundle?

80,000 items each month including food, energy, commodities, housing, healthcare, transportation etc.

How is data collected?

Governments spend significant resources to measure expenditure information accurately through targeted surveys

When is the report published?

The CPI reports are published every month

Are there any limitations of CPI?

- It is a conditional cost of living measure that does not take every aspect that affects living standards into account

- Unable to compare among different areas

- It may not apply to all population groups

- Sampling error- The chosen sample might not represent the entire population accurately

How to read the CPI report?

The figure is based upon the index average for the period from 1982 and 1984.

A reading of 125% means there is a rise in inflation level of 25% compared to the referenced period

Impact of CPI reports on trading

There are usually volatile movements if the actual figures differ from the consensus on a large scale.

If actual = consensus, then the markets may not react violently as they are already expecting that, and expectations were priced into the charts

– Good for currency: Actual > Forecast

Related Information

What is inflation?

When there is inflation, the purchasing power of a currency weakens. Consumers can now only purchase a portion of goods and services that they used to, with the same amount of money.

The Fed has to meet their inflation mandate, and therefore will deploy monetary policy tools to achieve that.

One of them being adjusting interest rates. Interest rates are of huge significance to the economy as it directly affects how willing people and businesses are to borrow money. It also affects how valuable one currency is relative to other currencies.

Breadmaker

All Things Trading

________________________________________________________________________________________________________________

Want to trade more than 300+ instruments with raw spreads starting from 0 pip and commissions as low as $2 per lot per side?

Sign up with FXPIG now!

Trading with VPS has been gaining popularity recently in the retail trading communities and there are solid reasons why.

- Ultra-Low Latency

The main reason why traders sign up for VPS is their concern for latency and the impact on their bottom line performance. Network latency is a term used to describe the delay in communication over a network. It is the amount of time it takes for a packet of data to be captured, transmitted, processed, and then received at the destination and subsequently getting decoded.

When trading in the financial markets, even milliseconds can result in a different outcome. The price of instruments can move during the time when an order is placed and a position is triggered. The differences may seem minimal but they will amount to a huge figure in the long run.

- Constant Connectivity

With a complete virtual Windows desktop that can be accessed anytime, anywhere in the world, VPS ensures that Expert Advisors (EA) can be run continuously

- Reduce Risks

VPS removes the risks associated with running EA on a local machine

Traders do not need to worry about risks such as power outages, system crashes, and internet connection issues.

- Greater Security

VPS enhances safety in trading as well by removing loopholes for security breaches. The hosted servers are monitored constantly by dedicated personnel and are properly equipped with advanced antivirus software.

–

Here are some numbers for our reference

Let’s say John is in Singapore and he is trading on his desktop. Whenever he places an order via his computer, the order is sent from his network to the broker’s trading servers, which most likely are located in data centers in either New York or London.

The average time taken for the orders to travel from Singapore to London is 157.380ms, according to https://wondernetwork.com/pings/London/Singapore .

Singapore and London (10841 KM)

For comparison purposes, let’s have a look at the ping time between other locations and London.

Paris and London (343 KM)

Johannesburg and London (9403 KM)

There is a major difference in the ping time (more than 15 times) due to geographical location and the physical distance the information packet has to travel.

This is why a VPS (situated in close proximity to the trading servers) can be so useful in trading in terms of execution speed, not to mention the other benefits including safety and reduced risk.

There are numerous VPS providers out there but you have to pay subscription fees for different plans. The Good News is that FXPIG is currently offering free VPS* to traders. Contact your account manager to learn more about free VPS now!

*Terms and conditions apply

Are you new to the trading industry and have no idea which trading platform is best for you? Or are you a seasoned trader and want to explore new trading platforms?

We are going to learn about the key points to consider when choosing a trading platform in this article. Then, we will lay out the pros and cons of MT4 and cTrader, two of the most widely used trading platforms for retail traders.

A trading platform is a medium where traders can view charts, do technical analysis, get market data, place trades among other functions.

Point 1: Functionality

Functionality includes

- the number of trading instruments available

(some brokers may not offer certain instruments on certain platforms) - timeframes customizability

- availability of technical indicators

- built-in economic calendar

(both MT4 and cTrader have it) - algorithmic trading

(EA on MT4 and cTrader Automate) - Community

(The MQL community for MetaTrader and C#/ CTDN community for cTrader)

Point 2: User Interface

The interface is the most direct point of interaction between the traders and trading platforms. Thus, it is imperative to choose one that is easy to understand, practical to use and some even take the cosmetic design into account.

Point 3: Compatibility

If you are currently running Windows OS, then compatibility issues shouldn’t bother you as it is used by more than 87% of computer users around the world, compared to 9.5% for Mac OS and 2.35% for Linux.

Some trading platforms only support certain OS, and you may need third party applications if you wish to run it on another OS that it does not support.

Point 4: Performance

Speed of execution is very critical for traders, and even more so for those that trade high frequency systems and the likes. A good platform executes orders with minimal lag. However, do bear in mind that many other factors affect the execution speed including but not limited to the network speed, types of connection, location between the servers and device hardware.

Comparing MT4 and cTrader

MetaTrader 4

MT4 has been in the industry since 2005 and it is still dominating the retail forex market.

Pros of MT4

- Beginner-friendly user interface

- Huge library of pre-built indicators

- Wide selection of automatic trading systems [Expert Advisors (EA)] available for purchase

- A big community of traders/ programmers specialise in MQL4, the programming language of MetaTrader 4

- Specially built smart trading tools (offered by FXPIG)

Cons of MT4

- User interface looks outdated

- Limited charting flexibility

- Lack of advanced order types (can be solved by using smart trading tools mentioned above)

cTrader

cTrader is relatively new compared to MT4 as it was released 5 years after. It offers the best out-of-the-box trading environment compared to MT4. Not only that, but it is also an ECN trading platform.

Pros of cTrader

- Modern and featured-packed user interface

- Access to more market data (especially market depth)

- More advanced charting capabilities

- Advanced order type

- Advanced cTrader Copy for copy trading

Cons of cTrader

- Not many brokers offer cTrader

- Lesser automated trading system for sale in the market

Verdict

Honestly, you can’t go wrong with either of them as they are both great platforms. Go with MetaTrader 4 if you are interested in the vast amount of EAs and indicators that are available in their store, and do not mind the outdated user interface. Opt for cTrader if you want a more modern-looking interface packed with functionalities, and access cTrader copy where there are tons of strategy providers that you can follow.

Bitcoin has historically had an uptrend in December. With the already massive 98% gain year-to-date, will we see yet another uptrend in December 2021?

Let’s address the chunky elephant before we start — Bitcoin is down about 13% from its highs of $68,521.

We’re at the level some finance guys would even consider it a “crash”. Truthfully, Bitcoin has seen better days, but let’s not forget, not many better years.

It’s still up about 98% from the start of the year — that’s a few percentage points more than any traditional assets. And we all know that’s an understatement.

Now that we’re at the last stretch of the year, we’re edging closer to the phenomenon repeatedly seen over the past years — A Christmas Bump — a period leading towards January where it’s common to see Bitcoin on an upward trend.

Bitcoin, 1 December 2016 to 31 December 2016

Bitcoin, 1 December 2017 to 31 December 2017

Bitcoin, 1 December 2018 to 31 December 2018

Bitcoin, 1 December 2019 to 31 December 2019

Bitcoin, 1 December 2020 to 31 December 2020

As of 3 December, Bitcoin is up about 98% year-to-date and it’s looking similar to 2016, 2017, 2019, and 2020. Out of these four years, three of them had their trend continue into December, adding on to the year’s gains.

The reasons for this speculation aren’t arbitrary either. It’s a combination of multiple elements that enables this month to greatly outperform other months. And for this year, it is looking just as promising as the positive catalysts line up.

So, who’s buying them?

Retail Market

For the past few years, Bitcoin’s explosive moves in November have made it an unmissable topic at the Thanksgiving dining table. Adding to this is the fact that Bitcoin has grown at an unprecedented rate each year, dwarfing almost every other traditional asset.

On top of that, with the help of influential people like Elon Musk and the constant buzz created by headlines with a grandiose three-figure percentage return in a year, the Internet is now plastered with talks around cryptocurrencies.

Everyone has heard of this term by now, but only a few are invested in them.

For those that are not invested, hearing these figures tends to incite a certain emotion in them. “It should have been me”, “It could have been me”, and “It would have been me if I had….”

Translated, this is something traders and investors know all too well but is only ever clear in hindsight — FOMO — the fear of missing out on something even greater.

Being able to notice this among other traders or investors is almost always a buy indicator, as what comes next is a wave of buyers coming into the same asset (Bitcoin) at the same time. In this case, giving the last month of the year a final push before heralding the new year’s.

Institutions

Just a few years ago, transacting in Bitcoin is considered a laughable notion.

“It’s too volatile” has become a phrase we’ve become too familiar with. But over the past year, fueled by the economic effects of the COVID-19 and controversy revolving around Robinhood and GameStop, sophisticated investors have begun to look for an alternative.

One of which is Bitcoin.

What followed suit was the assemblage of companies that also wanted to be involved. These companies are Microstrategy, Tesla, Square, and Coinbase. Together, they have over $12 billion invested in Bitcoin.

Not just the acquisition of Bitcoin and owning it for the sake of owning it or storage of value, but more and more companies are looking to have an integrated crypto payment system.

Twitter ($TWTR), had introduced their tipping feature, which includes using cryptocurrencies to their platform. Analysts are betting their money on Amazon to include cryptocurrencies as a payment method. And Facebook’s Novi, a digital currency wallet, is rather obvious proof that they’re working on it behind the limelight.

Combining the fact that companies are buying Bitcoin as a storage value and building the technologies that enable their crypto transactions, leads to more demand for cryptocurrencies. From both the institutional side and, eventually, the retail side.

Countries

Not even a decade back, all the talks were about how much gold does a country has. Today, presidents take it to Twitter to express their thoughts on Bitcoin and inflation.

Oh, what a world we live in!

The country that has been at the forefront of all of these is, of course, El Salvador. Their president, Nayib Bukele, has almost become a celebrity in the Crypto Twitter community because of his tweets around ‘buying the dip’ every time Bitcoin sees a price drop. As of the latest, El Salvador is reported to have over 1000+ Bitcoins in its reserves.

Though El Salvador is the only country with Bitcoin as a legal tender, there are more than a handful of other countries already in talks about doing the same thing. Paraguay, Panama, Brazil, Mexico, and Argentina, just to name a few.

The biggest reason why giant tech corporate’s and countries’ decisions make a difference is that they are the parties that will ultimately herald the mass adoption of cryptocurrencies. And with the amount of money these parties have compared to retail buyers, it is something to keep an eye out for.

Spot Crypto ETF

One of the biggest themes that sent Bitcoin on an upward trajectory this year was the notion of having a crypto ETF. But the SEC, the U.S. Securities and Exchange Commission, has said no over and over again. And then the news of an ETF that involves Bitcoin hit the streets. This was the ProShares Bitcoin Strategy ETF, otherwise known as $BITO.

But investors who were anticipating this event were quickly disappointed as they realised this is only a Bitcoin Futures ETF, not a Bitcoin Spot ETF. In simple terms, a Bitcoin Futures ETF does not directly track Bitcoin’s prices, and it’s not ideal to hold as a long-term investment due to its high cost. Speculators even highlighted that the SEC only approved this ETF due to its nature of being a futures investment.

On 2 December, painted all across the biggest financial publications, is the news that Fidelity is set to launch a cryptocurrency ETF. What’s, even more, is that it’s reported to be a spot ETF. The caveat is, this will be launched on the Toronto Stock Exchange, so not exactly available to US investors directly.

Regardless, having a top-tier fund manager launch an ETF that is directly involved with the underlying asset is, in most perspectives, a big win for Bitcoin and the cryptocurrency space as a whole.

Closing Thoughts

It’s arguably irrefutable to say Bitcoin has had an eventful year, and along with it, the entire crypto industry. But even with all that is happening and JP Morgan’s prediction that Bitcoin will hit $146,000 in the long-term, it is not to say it won’t keep performing the nose dive stunt and trigger all the stop losses while at it. Heck, maybe even giving President Nayib Bukele yet another opportunity to paint Twitter with his thoughts on buying the dip.

But with our data and the news coverage around this, it is more than likely that we will be seeing the Bitcoin charts reaching for the top right corner of your screens.

If you’re looking for access to a 24/7 crypto market, check out FXPIG for up to 60 crypto CFDs.

*Get a free upgrade to a Pro account by including “Crypto” in the promo code when you sign up. Terms and Conditions apply.

—

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.

FXPIG does not take into account your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by FXPIG. FXPIG also does not guarantee that such publications and information are up to date, accurate or applicable in any particular circumstances.

Any expression of opinion is personal to the author, and the author does not warrant the accuracy or completeness of any information or analysis supplied.

The authors and FXPIG are not responsible for any loss arising from any investment based on any perceived information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee or implication by FXPIG that clients will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here.

Trading on margin (spread betting, CFDs and FX) carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade your live account, you should carefully consider your investment objectives, level of experience and risk appetite. You could lose more than your initial investment and should not trade with funds you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial adviser if you have any doubts.

Fibonacci is a huge subject and there are many different Fibonacci studies with weird-sounding names but we’re going to stick to two: retracement and extension.

Few days ago my brother overheard me talking about the market and when I mentioned Fibonacci levels, in awe and surprise he almost yelled at me – What does Fibonacci has to do with your Forex, that is architecture!!!

So, for the sake of the peace in the world, let us first start by introducing you to the Fibo man himself…Leonardo Fibonacci, the king of the Castle!

No, no, he was not a king literally, and I doubt he had a castle, though his father was quite rich; and he is not some famous Italian chef, though he may sound like Pizza to you. You got partially right, he was Italian, and actually born in Pisa, but, he was a famous Italian mathematician, so, known as a super-duper uber ultra geek.

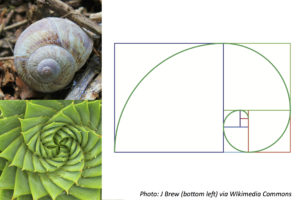

He had an “Aha!” moment when he discovered a simple series of numbers that created ratios describing the natural proportions of things in the universe. I had my “Ahaaaaa!” moment when I realized that his “Aha!” actually works.

The ratios arise from the following number series: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144…

This series of numbers is derived by starting with 0 followed by 1 and then adding 0 + 1 to get 1, the third number.

Then, adding the second and third numbers (1 + 1) to get 2, the fourth number, and so on.

After the first few numbers in the sequence, if you measure the ratio of any number to the succeeding higher number, you get .618.

For example, 34 divided by 55 equals .618.

If you measure the ratio between alternate numbers you get .382.

For example, 34 divided by 89 = 0.382 .

Well, now, that is way too serious. You can kill an elephant with all those numbers, though I don’t really see a point in killing an elephant. No one should kill an elephant for any reason.

Fibonacci Sequence

Back to the Fibo guy, enough elephants.

A Fibonacci sequence is formed by taking 2 numbers, any 2 numbers, and adding them together to form a third number.

Then the second and third numbers are added again to form the fourth number.

And you can continue this until it’s not fun anymore… And the fun never ends, so don’t… You should be trading, not adding numbers.

The ratio of the last number over the second-to-the-last number is approximately equal to 1.618.

This ratio can be found in many natural objects, so this ratio is called the golden ratio.

It appears many times in geometry, art, architecture, nature.

I have trillion more images to show that Fibonacci is everywhere, though some of them even I personally don’t like seeing, like Sonic the Hedgehog, which I still don’t understand how came to obsess my nephew.

And where is Forex in all this?!

Didn’t I say Fibonacci is everywhere?

Fibonacci retracement levels work on the theory that after a big price moves in one direction, the price will retrace or return partway back to a previous price level before resuming in the original direction.

Traders use the Fibonacci retracement levels as potential support and resistance areas.

Haters my say since so many traders watch these same levels and place buy and sell orders on them to enter trades or place stops, the support and resistance levels tend to become a self-fulfilling prophecy.

Traders use the Fibonacci extension levels as profit-taking levels.

Again, word is that since so many traders are watching these levels to place buy and sell orders to take profits, this tool tends to work more often than not due to self-fulfilling expectations… But, as long as it works, who cares why ?