Economic calendar

Wednesday – New Zealand official cash rate/ FOMC meeting minutes

Forex

EURUSD

EURUSD Daily Chart

The Euro strengthened against the greenback over the past 10 days and is just dancing on the 1.0600 level as we speak. 1.0650 will act as the immediate resistance standing in the way of the bulls while the 50 Moving average will be the next layer of resistance to the upside.

Gold

XAUUSD

XAUUSD Daily Chart

Gold climbed steadily last week after bouncing from 1785 support and is currently testing the 1855 trendline and resistance level. The rise could be due to the USD having a slight pullback in strength as we witnessed on the EURUSD also. If it breaks above the trendline again, we could see the bullish momentum resumes, although it is not as lucrative to hold gold considering the rising interest rates.

Energies

USOIL

USOIL Daily Chart

Crude oil was trading consistently in the upper half of its trading range with the 50 daily moving average acting as support. The driving season is also about to begin in the US, which is the peak season for oil demand. Shanghai is also due to reopen its city on June 1st. The outlook for crude oil remains bullish as demand is resuming sooner or later while supply is still tight. 115 will be the first resistance to break through and we will see from there.

Stocks

SP500

SP500 Daily Chart

From a technical standpoint, SP500 has been making lower highs and lower lows, Considering the rate of decline has been increasing ( the slope of the downfall has become steeper ), the next possible target could be 3750.

Cryptocurrencies

BTCUSD

BTCUSD Daily Chart

Bitcoin has been stuck in a tight range at around 30000 key areas for quite some time now. We are still waiting for the next market catalyst and there is no directional bias for now.

Don’t miss out on BIG market moves!

Sign up for an account at FXPIG now to trade more than 300 instruments, including 60+ Crypto CFDs, 24/7 with spreads as low as 1 cent!

Scope of agreement

This is a legal agreement (hereinafter the “Agreement”) between you and Prime Intermarket Group (“FXPIG”) for use of the website, data, FXPIG electronic trading platform, and products and services which you selected or initiated, which may include the FXPIG trading platform and third party signal providers (“Products and Services”).

1. FXPIG and the Third-Party Provider Platform

1.1. The Third-party provider Platform is an automated trading system, allowing FXPIG client to reproduce in his/her trading account held with the FXPIG (the “Trading Account”), in an automated way and subject to the application of various parameters and limitations, trading signals generated by third parties (the “Signal Providers” or “Traders”), as further set out in this agreement and explained on the Platform’s website.

1.2. Any reference to your “Account” in the Platform and generally in relation to FXPIG, for the purposes of this Agreement, shall mean the personalized operation of the Platform concerning you, your relations with FXPIG, and the transactions made by you through the use of the Platform’s functionality, as well as the capture and recording of such operation in the records and servers of FXPIG. Except for the purpose of receiving the applicable fees.

1.3. FXPIG does not undertake, by this Agreement to conduct any of your transactions either as your counterparty or as your broker and therefore assumes no liability in the event of non-performance (total or partial) or delayed execution of the signals generated through the Platform.

1.4. In addition to the automated generation of trading signals, the Platform allows you to generate your own trading signals (“manual” signals), as well as to monitor your transactions and be informed of their results and of your positions held with FXPIG in the context of your Trading Account(s) that are connected with the Platform.

2. Means of providing the service

2.1. By using the FXPIG Platform you acknowledge that you understand and accept the risks associated with Internet-based trading services including, but not limited to, hardware, software or Internet connection related issues, and the potential inability of timely transmission of the relevant communication due to interruptions and/or errors. Since FXPIG does not control signal power, its reception or routing via Internet, the configuration of your hardware or software, or the reliability of your Internet connection, you agree that you are solely responsible for such failures, including communication failures, disruptions, distortions, and delays in trading. FXPIG shall not be liable to any person for any losses, damages, costs, or expenses (including, but not limited to, loss of profits, loss of use, direct, indirect, incidental, or consequential damages).

2.2. No investment advice

2.2.1. FXPIG shall not provide to you with any kind of investment advice or other investment services. FXPIG offers solely the products and services that enable you to adopt trading strategies of other users of the Platform, based on the assumption that you have consciously chosen to conduct CFD and/or FX transactions with a Broker of your choice.

2.2.2. The history and statistics of the Signal Providers, the trading signals generated by the Signal Providers and the comments made by any Signal Provider on the Platform’s website do not constitute any kind of personal recommendation towards you or any other user to conduct or abstain from any transaction or to follow or unfollow any Signal Provider and should not be regarded as such.

2.3. Choice of Signal Providers

The Platform provides you the opportunity to trade based on automated electronic signals. You may adjust the Platform’s settings so that it replicates in the Account the actions of one or more Signal Providers of your choice.

The Signal Providers are third parties who use their signals to carry out transactions for their own account.

2.4. Limitations of the services and of FXPIG’s responsibility

2.4.1. FXPIG draws your attention to the following:

– The Signal Providers neither are related to FXPIG nor have they any professional certifications or titles with relation to financial markets.

– FXPIG does not intervene in the content of the signals produced by the Signal Providers.

– The Signal Providers do not have access to and do not take into consideration any of the personal information or the position of the account of any of their respective followers.

Generally, FXPIG shall not be liable to any person for any losses, damages, costs or expenses (including, but not limited to, loss of profits, loss of use, direct, indirect, incidental or consequential damages) occurring because trades cannot be executed due to market conditions.

2.4.2. By entering into this agreement, you acknowledge that you accept the risks inherent to the performance of transactions in the financial instruments supported by the Platform and provided to you by FXPIG and the Third party platform provider bears no liability for these risks. In particular you acknowledge:

i) That you are aware that transactions on financial instruments involve risks causing the reduction of the value of investments.

ii) That foreign exchange, CFDs and other leveraged trading activities involve significant risk of loss. Such activity is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

iii) That your trading results may vary depending on many factors. Because the risk factor is high in the foreign exchange, CFDs and other leveraged products, only genuine “risk” funds should be used in such trading. If you do not have the extra capital that you can afford to lose, you should not trade in leveraged products. No “safe” trading system has ever been devised, and no one can guarantee profits or freedom from loss.

v) That you are aware and accept the risks arising from the replication of investment strategies of third parties when using the FXPIG Platform and that past performance posted on the Platform is not indicative of future results.

2.4.3. FXPIG is not responsible for the actions or omissions of any other third party with respect to the transactions that you carry out with other Brokers for whatever reason.

2.4.4. FXPIG does not guarantee that the use of the Third-party Platform will have a positive result or a specific performance for you. Any reference to the performance of transactions carried out by users of the Platform or Signal Providers is related exclusively to the past and by accepting these terms you acknowledge that you are aware of such fact. Any reference to the performances of any Signal Provider may not take into account the costs of transactions, such as Signal Provider fees or any other fees applicable to your Copy Trading Account in the context of this Agreement.

2.4.5. The trades conducted by Signal Provider on his own trading account may involve amounts greatly different from the amounts allocated by you to each transaction following the Signal Provider’s activity. This may itself cause a significantly different result compared to the Signal Provider’s profits or losses even if the remaining characteristics of your positions are the same as the ones of the specific Signal Provider.

3. Authorizations

You hereby authorize the Signal Provider to access the Trading Account held by you with FXPIG, via all appropriate technical means and – to the extent necessary – the relevant competent personnel and executives thereof, in order

a) to connect the Platform to your Trading Account in a way to allow the introduction of the signals resulting from the operation of the Platform in your Trading Account;

b) to obtain full information about your Trading Account connected to the Platform, in order to be able to provide comprehensive information to you via the Platform;

c) to obtain information regarding your identification, for the purpose of providing the third-party Platform to you, receiving payments from you, and complying with any applicable rules (including for the prevention of money laundering)

4. The Signal Follower is entitled to do the following:

4.1. copy any number of Masters (the Copier Area lists all current subscriptions)

4.2. close any copied trade manually at any time in the copy trading account

4.3. unsubscribe from the Master and stop copying the Master’s trades by contacting FXPIG Support Team to unsubscribe. Upon unsubscription, all funds invested with the Master and the profit will remain in the Copier’s trading account

4.4. The Service is available on the Metatrader 4 platform and cTrader platform.

5. Opening copied trades routine:

5.1. The Copier only copies the trades that were opened by the Master after the subscription for the Master within the Service.

5.2. Upon the subscription to a Master, the Copier should fund the account with a specific amount to be invested with the selected Master prior to ‘start copying’. These funds and your profit will still remain in your copy trading account when you stop copying the Master.

5.3. The Copiers’ leverage ratio is set at 1:500 by default. Should the Copiers wish to adjust the leverage, please contact FXPIG’s Customer Support.

The Copier should take into consideration that if following the Master with same ratio while having a lower leverage may result in Margin Call or Stop Out.

5.4. Once the service is activated, the trades will be copied to the Copier’s account regardless of whether the owner of the account is signed in or not.

5.5. The Copier’s order is executed following the order (Buy or Sell) made in the Master’s account. When the Master places an order, the signal for opening an order triggers in the Copier’s account. The Copier’s order is executed at the market’s price. The same mechanism triggers the order closing. Therefore, the execution prices of these orders may differ. Additionally, the number of the Copiers following this Master can affect the execution time.

6. If the Master changes equity (by making a deposit or withdrawal) or leverage, all the copied trades maintain their initial volume on the Copier’s account.

7. All trading conditions (leverage, swaps, spreads) of the Copiers’ are similar to the ones for the FXPIG MT4 and cTrader accounts.

8. The Service is entitled to do the following:

8.1. restrict the number of Master Accounts the Masters may create at any time without prior notification at its sole discretion

8.2. unsubscribe the Copier from the Master without prior notification..

9. The Master determines the performance fee amount for copying orders. The performance fee can range from 0% to 30% of the Copier’s gain

10. The commission structure that the Copier pays to the Master is set at the moment when the Copier presses ‘Start Copying’ and/or starts copying the master’s. If the Master changes the commission amount, it does not affect the amount due under this subscription to the Master.

11. Commission amounts for the IB. The Master can also be an IB for the Copier. In this case, they will receive both the IB commission and the performance fee for copying.

12. Free Trial

12.1. The Master Trader can activate and disable the Free Trial at any moment.

12.2. The Free Trial automatically activates when the Copier initiates copying the Master Account if:

12.2.1. the Master Trader has the Free Trial available for this Master Account

12.2.2. the Copier has not previously activated the Free Trial for this Master Account.

12.3. If the Master Trader voids the Free Trial, it continues to work for the Copiers who have already activated it.

12.4. If the Copier stops copying the Master Account while the Free Trial is active, the Copier cannot reactivate the Free Trial for this Master Account.

12.5. After the Free Trial expires, the Copier’s subscription becomes subject to the prior conditions, including the commission structures.

13. The Copier’s trading statistics can only be viewed by the Copier.

14. The Master’s trading statistics are available for the public and or subject to Master’s visibility settings (cTrader).

15. The Copiers do not have access to the trading terminal. All actions with their subscriptions and trades are made under the Copier Area by the Master Traders.

16. If the Service reasonably suspects that the Copier violated the Deposit and Withdrawal rules set out under the Customer Agreement or the legislation of the country of the Copier’s residence, the Service is entitled to suspend providing the services to such Copier.

17. Final provisions

17.1. Representation regarding funds

By accepting these terms and proceeding to the opening and operation of your Account, you represent and certify to FXPIG that

a) all amounts of money that you have deposited and/or will deposit with your FXPIG belong to you, are from a legal source and do not derive from acts or activities falling within the prohibitions of the laws on the prevention and suppression of money laundering;

b) generally you shall comply with the legal provisions and shall not engage in illegal or prohibited actions or practices;

17.2. Restrictions to the use of Platform Information

By viewing FXPIG’s website and trading on Platform, you fully understand and agree to respect the proprietary rights of Signal Providers and of FXPIG, and you represent that you do not desire to acquire from the Signal Providers any trade secrets or confidential information.

You represent that you will be using signals solely for your own FXPIG Account and that you will not be reproducing such signals with any third-party platforms or services outside of the FXPIG platform. Immediately upon notice from FXPIG that, in FXPIG’s opinion, any use of the Platform does not comply with this standard, you will cease such manner of use. Furthermore you agree that FXPIG may at its sole discretion disable your access to the Platform at any time, in the case of system abuse or any infringement of any patent, copyright, trademark or other proprietary right or infringement upon a trade secret of any person or entity, or other reasons not described in this Agreement.

18. Duration – Termination

This agreement is of indefinite duration. The agreement shall take effect after acceptance by the Client and upon the opening of the Account by FXPIG, and shall be terminated upon the closure of the Account. The Account may be closed either by a request from you, subject to FXPIG’s acceptance and provided that no Fees are outstanding, or in FXPIG’s initiative with a reasonable notice or – in the case of inactive accounts – with no notice.

18.1. Governing law – Jurisdiction

18.2. All contractual relationships between FXPIG and the Client are governed by the laws of Vanuatu.

18.2.1. FXPIG shall have the right, at any time and under its sole and absolute discretion, to unilaterally change and/or amend the terms and conditions of this Agreement. You agree that any new format of this Agreement which shall be posted on FXPIG’s Website shall be considered as sufficient provision of notice for the changes and/or amendments made in such new format and shall become effective as of the date of posting it as aforesaid.

18.2.2. You shall not assign or transfer in any way to third parties any of your rights and claims arising from your relations with FXPIG under this Agreement, unless otherwise agreed in writing.

Bitcoin has historically had an uptrend in December. With the already massive 98% gain year-to-date, will we see yet another uptrend in December 2021?

Let’s address the chunky elephant before we start — Bitcoin is down about 13% from its highs of $68,521.

We’re at the level some finance guys would even consider it a “crash”. Truthfully, Bitcoin has seen better days, but let’s not forget, not many better years.

It’s still up about 98% from the start of the year — that’s a few percentage points more than any traditional assets. And we all know that’s an understatement.

Now that we’re at the last stretch of the year, we’re edging closer to the phenomenon repeatedly seen over the past years — A Christmas Bump — a period leading towards January where it’s common to see Bitcoin on an upward trend.

Bitcoin, 1 December 2016 to 31 December 2016

Bitcoin, 1 December 2017 to 31 December 2017

Bitcoin, 1 December 2018 to 31 December 2018

Bitcoin, 1 December 2019 to 31 December 2019

Bitcoin, 1 December 2020 to 31 December 2020

As of 3 December, Bitcoin is up about 98% year-to-date and it’s looking similar to 2016, 2017, 2019, and 2020. Out of these four years, three of them had their trend continue into December, adding on to the year’s gains.

The reasons for this speculation aren’t arbitrary either. It’s a combination of multiple elements that enables this month to greatly outperform other months. And for this year, it is looking just as promising as the positive catalysts line up.

So, who’s buying them?

Retail Market

For the past few years, Bitcoin’s explosive moves in November have made it an unmissable topic at the Thanksgiving dining table. Adding to this is the fact that Bitcoin has grown at an unprecedented rate each year, dwarfing almost every other traditional asset.

On top of that, with the help of influential people like Elon Musk and the constant buzz created by headlines with a grandiose three-figure percentage return in a year, the Internet is now plastered with talks around cryptocurrencies.

Everyone has heard of this term by now, but only a few are invested in them.

For those that are not invested, hearing these figures tends to incite a certain emotion in them. “It should have been me”, “It could have been me”, and “It would have been me if I had….”

Translated, this is something traders and investors know all too well but is only ever clear in hindsight — FOMO — the fear of missing out on something even greater.

Being able to notice this among other traders or investors is almost always a buy indicator, as what comes next is a wave of buyers coming into the same asset (Bitcoin) at the same time. In this case, giving the last month of the year a final push before heralding the new year’s.

Institutions

Just a few years ago, transacting in Bitcoin is considered a laughable notion.

“It’s too volatile” has become a phrase we’ve become too familiar with. But over the past year, fueled by the economic effects of the COVID-19 and controversy revolving around Robinhood and GameStop, sophisticated investors have begun to look for an alternative.

One of which is Bitcoin.

What followed suit was the assemblage of companies that also wanted to be involved. These companies are Microstrategy, Tesla, Square, and Coinbase. Together, they have over $12 billion invested in Bitcoin.

Not just the acquisition of Bitcoin and owning it for the sake of owning it or storage of value, but more and more companies are looking to have an integrated crypto payment system.

Twitter ($TWTR), had introduced their tipping feature, which includes using cryptocurrencies to their platform. Analysts are betting their money on Amazon to include cryptocurrencies as a payment method. And Facebook’s Novi, a digital currency wallet, is rather obvious proof that they’re working on it behind the limelight.

Combining the fact that companies are buying Bitcoin as a storage value and building the technologies that enable their crypto transactions, leads to more demand for cryptocurrencies. From both the institutional side and, eventually, the retail side.

Countries

Not even a decade back, all the talks were about how much gold does a country has. Today, presidents take it to Twitter to express their thoughts on Bitcoin and inflation.

Oh, what a world we live in!

The country that has been at the forefront of all of these is, of course, El Salvador. Their president, Nayib Bukele, has almost become a celebrity in the Crypto Twitter community because of his tweets around ‘buying the dip’ every time Bitcoin sees a price drop. As of the latest, El Salvador is reported to have over 1000+ Bitcoins in its reserves.

Though El Salvador is the only country with Bitcoin as a legal tender, there are more than a handful of other countries already in talks about doing the same thing. Paraguay, Panama, Brazil, Mexico, and Argentina, just to name a few.

The biggest reason why giant tech corporate’s and countries’ decisions make a difference is that they are the parties that will ultimately herald the mass adoption of cryptocurrencies. And with the amount of money these parties have compared to retail buyers, it is something to keep an eye out for.

Spot Crypto ETF

One of the biggest themes that sent Bitcoin on an upward trajectory this year was the notion of having a crypto ETF. But the SEC, the U.S. Securities and Exchange Commission, has said no over and over again. And then the news of an ETF that involves Bitcoin hit the streets. This was the ProShares Bitcoin Strategy ETF, otherwise known as $BITO.

But investors who were anticipating this event were quickly disappointed as they realised this is only a Bitcoin Futures ETF, not a Bitcoin Spot ETF. In simple terms, a Bitcoin Futures ETF does not directly track Bitcoin’s prices, and it’s not ideal to hold as a long-term investment due to its high cost. Speculators even highlighted that the SEC only approved this ETF due to its nature of being a futures investment.

On 2 December, painted all across the biggest financial publications, is the news that Fidelity is set to launch a cryptocurrency ETF. What’s, even more, is that it’s reported to be a spot ETF. The caveat is, this will be launched on the Toronto Stock Exchange, so not exactly available to US investors directly.

Regardless, having a top-tier fund manager launch an ETF that is directly involved with the underlying asset is, in most perspectives, a big win for Bitcoin and the cryptocurrency space as a whole.

Closing Thoughts

It’s arguably irrefutable to say Bitcoin has had an eventful year, and along with it, the entire crypto industry. But even with all that is happening and JP Morgan’s prediction that Bitcoin will hit $146,000 in the long-term, it is not to say it won’t keep performing the nose dive stunt and trigger all the stop losses while at it. Heck, maybe even giving President Nayib Bukele yet another opportunity to paint Twitter with his thoughts on buying the dip.

But with our data and the news coverage around this, it is more than likely that we will be seeing the Bitcoin charts reaching for the top right corner of your screens.

If you’re looking for access to a 24/7 crypto market, check out FXPIG for up to 60 crypto CFDs.

*Get a free upgrade to a Pro account by including “Crypto” in the promo code when you sign up. Terms and Conditions apply.

—

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.

FXPIG does not take into account your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by FXPIG. FXPIG also does not guarantee that such publications and information are up to date, accurate or applicable in any particular circumstances.

Any expression of opinion is personal to the author, and the author does not warrant the accuracy or completeness of any information or analysis supplied.

The authors and FXPIG are not responsible for any loss arising from any investment based on any perceived information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee or implication by FXPIG that clients will profit or that losses in connection therewith can or will be limited, from reliance on any information set out here.

Trading on margin (spread betting, CFDs and FX) carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade your live account, you should carefully consider your investment objectives, level of experience and risk appetite. You could lose more than your initial investment and should not trade with funds you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial adviser if you have any doubts.

The risk-on mood extends for the second straight day this Tuesday, as most Asian stock markets are rallying, in anticipation of the ECB and BOC monetary policy decision. Meanwhile, a likely delay in the Fed’s tapering plan and hopes of more stimulus from China keep investors cheerful.

Prevailing an upbeat mood weighs on the US Treasuries, lifting the yields, in turn checking the renewed downside in the US dollar across the board. The greenback is attempting another bounce, as markets move past the effects of a disappointing US NFP report. The futures tied to the US stocks also edge higher, suggesting a positive start on Wall Street, as traders return after a three-day weekend.

Amid the resurgent dollar’s demand, most major currency pair have turned south, with the Antipodeans emerging as the main laggards. AUD/USD drops back towards 0.7400 after spiking to 0.7470, in an initial reaction to the RBA policy decision. The RBA kept the rates on hold at 0.10% while sticking to its tapering plans.

EUR/USD’s recovery faltered at 1.1885 amid rallying yields, as it now edges lower towards 1.1850. Investors shift their focus towards the German ZEW Survey and Eurozone GDP final revision.

The S&P 500 futures are alternating between gains and losses around 4,535 while the US 10-year Treasury yields consolidate Friday’s sharp rally above 1.30%. The US dollar is staging an impressive bounce, taking cues from the recovery in the Treasury yields.

GBP/USD is retreating below 1.3850 despite the upbeat Brexit news. The UK and EU extended the post-Brexit grace period over Northern Ireland indefinitely. The UK’s Brexit Minister David Frost revealed a fresh extension, with no new deadline set for the completion of talks, per The Guardian.

Gold price is retreating towards $1815, having failed to find acceptance above $1830, as all eyes remain on the ECB outcome on Thursday.

Cryptocurrencies are on the defensive. Bitcoin trades close to four-month highs above $52,000.

Life, like Forex, comes down to choices and decisions… or wait, should I say, Forex, like life, comes down to choices and decisions. Either way, you get the point.

A while back, thanks to the ‘modern miracle’ called Facebook, I got reacquainted with my childhood best friend, whom I hadn’t seen in nearly twenty years. You know the story; the closest of friends in school, the pair that used to do everything together, then school ends, and life happens. Years pass and you happen to catch the tail-end of some movie you two watched a million times together, and you wonder how your old chum turned out? So you do what everyone does… you cyber-stalk him on Facebook.

On the face of it, my cyberstalking, er, sleuthing, showed that he was doing well; he had a nice job, a decent place to live, and he and his wife looked happy. After an awkward first chat, where I seemed to confirm what I saw on his timeline, and where we reminisced about years passed, I got a follow-up call from him a few days later… and it was a WHOLE different story.

Come to find out that colorful and joyful social timeline was a ruse, who’d a thought? In reality, my old friend was utterly distraught. He goes on to tell me that he and his wife are a ‘couple’ by name only, any resemblance of a relationship fizzled long ago. Not to mention his house, which was bought on an adjustable line of credit, was absolutely killing his finances. And to top it off, he was suffering from a bought of homesickness, having moved away from his family to accommodate his marriage. To make it short; he made a bad choice, well, honestly, he made a LOT of bad choices.

The real irony here? We ALL make bad choices. If fact most of us make MOSTLY bad choices. Life doesn’t come with a manual, and unfortunately, once you know how to live it, or at least have a better idea, you’re normally to damn old to enjoy it. In life when we are aware we have made a bad choice, it’s time to slow down, regroup, and make a decision, to either stay with the choice we made or accept the fact we made a mistake, correct it, and move on.

In forex, however, there IS a manual, in fact, there is a shit ton of manuals, however, somehow, we STILL make bad choices. Whether we misinterpret the market, or misread fundamentals, or follow the wrong technical indicator, invest in the wrong PAMM at the wrong time… just like in life, those bad choices have a COST, and just like in life, bills, unlike mail you actually want, never arrive late in the mail.

And here comes the hardest lesson of all… when you are faced with a tough choice, a choice between two shitty options, and you are forced to make a decision. Many people, when they find themselves in such a dilemma, assume they need to fix something. We have all heard the saying, ‘If it ain’t broke, don’t fix it,’ well today I am going to introduce you to this lesser known gem, ‘If it’s broke… buy a new one.’ If you KNOW you made a bad choice, living with it until it destroys you is NOT an option… for sane people anyway.

Step one is to acknowledge the mistake. OWN it. You made a choice, it’s your fault, and despite repeated attempts, no, you cannot blame someone else. The reason it is so damn hard to get past this point is that pesky thing psychologists like to call self-righteousness, one of those inherent human traits that help slow the evolutionary process. Unfortunately, self-righteousness doesn’t get along well with wisdom, and you guessed it… it takes wisdom to acknowledge when you have made a mistake.

Step two is all about courage. Now I am not trying to say that most people are cowards, but nearly ALL of us are afraid to admit when we are wrong, which in forex means almost NONE of us are keen at a taking a loss. You know, those of us that mutter ‘An equity loss is not a REAL loss,’ under our breath as our account slowly gets slaughtered by one of those aforementioned bad choices. And for the record… a loss is a loss. Equity, balance, whatever.

In the end, when most of us are faced with the choice of cutting the loss or taking a stand, making a clear decision, and actually doing something to correct the mistake we don’t want to admit we made… we simply do nothing. The irony here is that not making a decision is, in fact, making the WRONG decision, the de facto decision of letting fate decide the outcome for us.

Instead of closing the trade, the trade we KNOW was a mistake, we just let it run, and hope the market will turn in our favor. HOPE is NOT a form of market analysis. Next time you want to rely on hope do yourself a favor and walk away from your desk, smash your phone, throw your tablet out of the window, and HOPE that your internet falls offline so you can’t trade. Oh and call yourself Mr. Retail, and Mr. 95% for a few days to let it sink in how NOT ready you are to trade alongside the big boys.

It turns out my friend didn’t make a decision either. So there he sits, in a bad relationship, a mountain of debt, and with a cloud of depression hanging over him. All because he did not want to admit his mistakes, and decide to cut his losses, clear his mind, and start looking for the next market opportunity, on the road to recovery.

On occasion, the market does give you a second chance. Life? Not so often.

Oh, and my friend and his ‘loving’ wife now have a baby on the way. So much for cutting your losses. It seems he now has no choice but to go down with the ship like any self-respecting Captain.

Me? I would MUCH rather be a Sailor… getting away on the last life raft. Dignified? Maybe not. Honorable? Not too sure. Smart? You better believe it…

The market mood has improved amid speculation that the Fed refrains from early tapering amid the rapid spread of the Delta covid variant. The safe-haven dollar is reversing some of its gains. Preliminary PMIs are high on the agenda, and Bitcoin is on the rise.

After a week dominated by concerns that the Federal Reserve would announce a tapering of its bond-buying scheme, investors are now foreseeing a delay. Robert Kaplan, President of the Dallas branch of the Fed, said he would consider postponing such a move in response to the impact of the Delta covid variant. Kaplan is a hawk and had previously pushed for withdrawing stimulus.

The focus is on the Fed’s Jackson Hole Symposium and the speech by Chair Jerome Powell on Friday. Over the weekend, the bank announced that the event would be held virtually, a move seen as acknowledging the severity of the current wave of the disease.

Some speculate that Powell could use the Jackson Hole speech to signal a delay in withdrawing stimulus rather than bringing it forward. Markets are cheered by reports that the White House would extend Powell’s term as Fed Chair by another four years.

US coronavirus cases have hit a daily average of 149,000, ten times more than in early June. Hospitals in several southern states remain stressed. On the other hand, China said it has eliminated the spread of the Delta strain, allowing the lifting of lockdowns in the world’s second-largest economy.

The upbeat mood in markets has pushed the safe-haven dollar down with EUR/USD recapturing 1.17. Markit’s preliminary Purchasing Managers’ Indexes for August are due out during the morning and are set to remain on high ground.

UK PMIs are of interest to the pound, which is struggling with stubbornly high British covid cases. GBP/USD is trading around 1.3650.

The improved market mood is also supporting oil prices, with WTI topping $63. Gold is hovering around $1,785, within familiar ranges.

Cryptocurrencies had a successful weekend, with Bitcoin surging above $50,000, the highest levels since May. Ethereum is trading above $3,300 and other digital assets such as Cardano and Dogecoin are on the move.

Fibonacci is a huge subject and there are many different Fibonacci studies with weird-sounding names but we’re going to stick to two: retracement and extension.

Few days ago my brother overheard me talking about the market and when I mentioned Fibonacci levels, in awe and surprise he almost yelled at me – What does Fibonacci has to do with your Forex, that is architecture!!!

So, for the sake of the peace in the world, let us first start by introducing you to the Fibo man himself…Leonardo Fibonacci, the king of the Castle!

No, no, he was not a king literally, and I doubt he had a castle, though his father was quite rich; and he is not some famous Italian chef, though he may sound like Pizza to you. You got partially right, he was Italian, and actually born in Pisa, but, he was a famous Italian mathematician, so, known as a super-duper uber ultra geek.

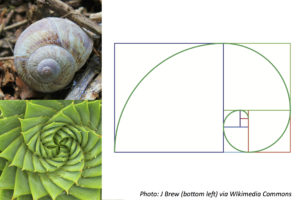

He had an “Aha!” moment when he discovered a simple series of numbers that created ratios describing the natural proportions of things in the universe. I had my “Ahaaaaa!” moment when I realized that his “Aha!” actually works.

The ratios arise from the following number series: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144…

This series of numbers is derived by starting with 0 followed by 1 and then adding 0 + 1 to get 1, the third number.

Then, adding the second and third numbers (1 + 1) to get 2, the fourth number, and so on.

After the first few numbers in the sequence, if you measure the ratio of any number to the succeeding higher number, you get .618.

For example, 34 divided by 55 equals .618.

If you measure the ratio between alternate numbers you get .382.

For example, 34 divided by 89 = 0.382 .

Well, now, that is way too serious. You can kill an elephant with all those numbers, though I don’t really see a point in killing an elephant. No one should kill an elephant for any reason.

Fibonacci Sequence

Back to the Fibo guy, enough elephants.

A Fibonacci sequence is formed by taking 2 numbers, any 2 numbers, and adding them together to form a third number.

Then the second and third numbers are added again to form the fourth number.

And you can continue this until it’s not fun anymore… And the fun never ends, so don’t… You should be trading, not adding numbers.

The ratio of the last number over the second-to-the-last number is approximately equal to 1.618.

This ratio can be found in many natural objects, so this ratio is called the golden ratio.

It appears many times in geometry, art, architecture, nature.

I have trillion more images to show that Fibonacci is everywhere, though some of them even I personally don’t like seeing, like Sonic the Hedgehog, which I still don’t understand how came to obsess my nephew.

And where is Forex in all this?!

Didn’t I say Fibonacci is everywhere?

Fibonacci retracement levels work on the theory that after a big price moves in one direction, the price will retrace or return partway back to a previous price level before resuming in the original direction.

Traders use the Fibonacci retracement levels as potential support and resistance areas.

Haters my say since so many traders watch these same levels and place buy and sell orders on them to enter trades or place stops, the support and resistance levels tend to become a self-fulfilling prophecy.

Traders use the Fibonacci extension levels as profit-taking levels.

Again, word is that since so many traders are watching these levels to place buy and sell orders to take profits, this tool tends to work more often than not due to self-fulfilling expectations… But, as long as it works, who cares why ?

So, like most days, I find myself here, staring at price grids waiting anxiously for a trigger to get into the market, and from some distant place, I faintly hear someone saying… no, yelling… ‘It’s GREEN moron.’ I suddenly come to the realization that I am not sitting at my desk, looking at a sea of charts and indicators, but standing on the sidewalk, staring down at the crosswalk huddled amidst the mid-morning rush hour… simply waiting for the light to turn.

What’s the name of this blog series? Oh yeah, OBSESSED. I think it fits nicely.

Seriously, you absolutely KNOW you need help when EVERY mundane aspect of your day literally BECOMES ‘forex’ed’. I am so far gone I even hear a repeating jingle in my head, reminiscent of the old tootsie roll song;

“Whatever it is I think I see… becomes a forex indy to me”

Certifiable… I know… However, once that ‘Forex Switch’ gets turned on, it’s hard to turn off. Mostly, on the face of it, life seems quite structured compared to FX. There are rules, and if you follow them, for the most part, it’s pretty easy sailing. If you’re crossing the street, you press a button, wait for a signal, and trot across those zebra lines without even a second thought. Heck, most people are so busy updating their status, so the rest of the world knows they are crossing the street, that they don’t even look up to see if it truly is clear to pass. BUT… they still make it across.

The question then becomes WHY is it we cannot apply these same ideas to the market to make it as easy to be a profitable trader as it is to cross the street? I mean ‘smart’ guys have already invented a ton of ‘signals,’ everything from indicators to Japanese Candles to recognizable chart patterns, so what is the problem? Is it me, it is us? What then?

Here I remain, glaring intently at the street light, glancing back at the street, anxiously awaiting it to turn… KNOWING it is going to turn… looking again at the light… noticing there is no traffic in sight. I guess I can just go NOW, right? I mean, after all, I KNOW it is going to turn, and I can’t see any cars coming.

Sound familiar?

The old, ‘the market is going to turn at any moment, I am SURE of it, so no need to wait for the actual trigger. I KNOW I am right, and it is EVIDENT the market will agree with me…. any minute now.

Okay, yeah, got it, don’t break the rules, stick to plan, etc. understood. How come then, even when I play by the rules, following them to a ‘t’, the trade I take, the trade I waited ALL day to take, the one that had me stressing out for HOURS, STILL doesn’t turn out as expected.

This my friends is an important lesson… The market does what the market wants to do, it has no boss, and there is no market police force to give it a ticket when it decides to jaywalk right over your cute little trading plan.

The point to this story? I have never in my life heard of a person being hit by a street light while crossing a street. Even when it’s green, make sure you ALWAYS mind the cars and not the streetlights.