Economic Calendar

| Day | Event |

| Friday | NZD Bank Holiday |

Forex

EURUSD

EURUSD H4 Chart

The fiber has been edging higher towards the 1.06000 key level, currently trading at 1.05 ish between the 50 and 200 moving average. Consecutive higher lows created a bullish trendline on the 4-hour chart and the pair may be more inclined to the bullish side in the short term, with the PMI coming out lower than expected (52.4 vs 56)

Precious Metal

XAUUSD

Gold H4 Chart

With lower highs being made and both moving averages applying downwards pressure, gold is positioned for a bearish break from its consolidation range. It traded as high as 1846 before the PMI figures were released. It plunged shortly after the announcement to a low of 1822.60. If it does break from its current range, the first target price level is 1788.

Energies

Crude Oil

USOIL Daily Chart

Crude oil tumbled 5.35% this week. The aggressive rate hike by the Fed is triggering fears that the economy may slide into a recession and reducing the demand for crude oil which cause the sell-off in crude over the past 2 weeks. After an indecisive day yesterday (-0.4%), we shall see if crude will extend its sell-off to end the week lower. Underneath is the $94 key support coinciding with the 200 daily moving average.

US Stocks

SP500

SP500 Daily Chart

SP500 is slowly recovering to trade above 3750 again after 2 consecutive weeks with more than a 5% loss. If the index can hold on to its gains later during the NY session then we will be looking at a green week. The next key level to watch out for is 4000 which will most likely coincide with the 50 daily moving average.

Fed Chair Jerome Powell toned down his language when he testified before the lawmakers on Thursday, stating that the Fed is “strongly committed” to fighting inflation compared to the term “unconditional” that was used previously.

Cryptocurrencies

Bitcoin

BTCUSD Weekly Chart

Having lost 70% of its value from its all-time-high, market-leading cryptocurrency Bitcoin is hanging on to its life. With the strong bearish momentum that is building up, we are doubting if 20000 can hold. The next key price will be its first all-time-high at 19k ish.

Welf

Trader, Technical Analyst

________________________________________________________________________________________

Don’t miss out on BIG market moves!

Want to trade more than 300+ instruments with raw spreads starting from 0 pip and commissions as low as $2 per lot per side?

Sign up with FXPIG now!

Economic calendar

Key Events for this week

Monday- Australian Bank Holiday

Tuesday- USD PPI

Wednesday- FOMC Statements and Federal Funds Rate. There will be an FOMC press conference 30 minutes after the statements

Thursday- CHF interest rates, GBP Interest rates

Friday- Fed Chair Powell speaks

Inflation: CPI Recap

CPI figures last Friday surprised us, but not in a good way. Both CPI and Core CPI came out higher than expected with CPI rising 8.6%YoY and core inflation at 6%. Fuel oil alone was up 106.7% over the past year, can you imagine paying double on your car fuel? Well, you don’t need to imagine anymore as that is the reality in the US now.

USDJPY

USDJPY Daily Chart

Following up on our analysis last Friday, USDJPY did continue to rally as predicted. Yen slumps to a 20-year low as BOJ stands firm on their easing monetary policy unless the pair breach 140 in an effort to support their slow recovery from the pandemic. Governor Kuroda also emphasized that exchange rates aren’t policy targets. With the Fed expected to raise its interest rates by another 25 basis points during the FOMC statement later this week, the Yen might slide further. The next resistance is marked at 136.50 area but please note that this level is formed 24 years ago. The next medium-term support is at 131.

EURUSD

EURUSD Daily Chart

The Euro continued to weaken against the US dollar ahead of the interest rates announcement this week. Technical-wise, the price respected the 50 daily moving average and resume its bearish movement. Currently trading at 1.0488, the pair is looking very likely to test the next support at 1.0350 due to the USD’s strength.

GBPUSD

GBPUSD Daily Chart

To meet the inflation target, the BOE is set to raise rates on Thursday by 25 basis points, from 0.75% to 1%. Will this move give the Pound a much-needed boost to turn the trend on GBPUSD, or at least stop the Pound from falling further? It is currently sitting on 1.2250. The next key support is situated 250 pips below while resistance is at 1.2650.

Precious Metals

XAUUSD

Gold Chart H4

Gold spiked more than $40 after CPI came out last Friday, with the wicks covering both the bottom and the top end of its trading range. We are still waiting for a breakout from this 3-week long consolidation and the FOMC announcements this week may be it.

On the top, we have 1890 as the next resistance and the lower end of the trading range as the support

Energies

Crude Oil

USOIL Daily Chart

Bullish momentum has slowed down on crude oil. Prices fell for 2 consecutive trading days and continued to slide as markets open today. The reason being China warned of a serious spread in Beijing and is conducting more mass testing until Wednesday, which makes China the near-term downside risk for crude prices. The next support is the previously broken resistance at $115 while the upside target is at $129.

US Stocks Markets

SP500

SP500 Daily Chart

Investors aren’t too optimistic about the inflationary numbers as reflected by the sell-off in SP500. The index fell nearly 6% in the past 3 trading days and the next strong support can be found at the 3700 key level. On the other hand, resistance is at 4150 where the price did a U-turn the last time it went there.

Cryptocurrencies

Bitcoin Daily Chart

Bitcoin has broken out from its month-long consolidation phase and is heading South. It has lost 16% in the past 4 days alone amid heightening inflation concerns. Revisiting the 18-months low definitely isn’t something that Bitcoin hodlers/ investors want to see. Other cryptocurrencies are not safe either as the bearish waves swept through the the crypto universe with Ethereum, Cardano and Solana shaved 30%, 28%, and 35% respectively.

Interest rates effect:

Canada and Australia have raised their interest rates last week to combat inflation, while ECB said it would begin rate hikes in the summer and stop purchasing assets. As the interest rates of different major currencies rise, the costs of holding other assets such as cryptocurrencies increase, further reducing the demand and subsequently the prices of these assets.

Let’s hope that the 23000 is able to provide support. If not, we are very interested in the 19000 area where Bitcoin made its significant all-time high.

Welf

Trader, Technical Analyst

________________________________________________________________________________________

Don’t miss out on BIG market moves!

Want to trade more than 300+ instruments with raw spreads starting from 0 pip and commissions as low as $2 per lot per side?

Sign up with FXPIG now!

Economic calendar

Today- US CPI at 8:30 EST

Forex

USDJPY

USDJPY Daily Chart. Source: TradingView

The dollar continued to strengthen against the Yen due to interest rate differentials. BOJ still firm on its dovish stance, with analysts predicting that it will remain this way until the current BOJ governor, Kuroda’s term is over in the coming year. Trading just above 134.00, the pair is just one Yen, or 100 pips away from its 2 decades high, made back in 2002. We are expecting the pair to continue rising and test the mentioned 2 decades high. Next support is marked at 132.5, its previous swing low on the 4 hour chart.

Metals

Gold

XAUUSD H4 Chart. Source: TradingView

Gold failed to make a higher high and is now trading below both the 50 and 200 moving averages on the 4-hour chart. Not only that, but the bulls also couldn’t win the tug of war in the 1855 decision area. The metal is positioned for a bearish move, but we should wait for the CPI numbers later today for a firmer direction. The inflation rate Year over Year is expected to stay the same as the previous’s reading while the core inflation (excluding food and energy prices) is expected to cool down by 0.1%.

Energies

Crude Oil

USOIL H4 Chart. Source: TradingView

Technical wise, crude oil steadies with higher lows and higher highs made over the week. The gasoline demand in the US has been increasing due to the start of the summer travel season, lockdowns in China began to ease and supplies remain tight, these are some of the main factors pushing the crude prices up. $129 recent highs are still in sight with the 50 moving average as the immediate support.

US Stocks

SP500

SP500 Daily Chart. Source: TradingView

After trading above the 4100 for a few days, SP500 couldn’t hold the level and it fell 2.27% during yesterday’s session. Could that be a lower high being made? We shall wait for the CPI report later as inflation is the main driver of investors’ sentiment in the stocks market now.

Cryptocurrencies

Bitcoin

BTCUSD Daily. Source: TradingView

As capital fled away from risk assets due to global uncertainties, the trading volume of Bitcoin has diminished significantly. It has been consolidating for a whole 30 days and there looks to be no upcoming big market catalyst to move the cryptocurrency. For trend traders, we shall wait for a breakout.

Welf

Trader, Technical Analyst

________________________________________________________________________________________

Don’t miss out on BIG market moves!

Want to trade more than 300+ instruments with raw spreads starting from 0 pip and commissions as low as $2 per lot per side?

Sign up with FXPIG now!

Economic Calendar

Monday- Bank Holidays for Australia, New Zealand, Switzerland, France, and Germany

Tuesday- Cash Rate for AUD

Thursday- EUR monetary policy statement

Friday- US CPI

Forex

EURUSD

EURUSD Daily Chart

EURUSD’s retracement momentum has slowly faded with a 50 daily moving average applying bearish pressure. 1.0800 is the next resistance level where most traders look for short opportunities. Additionally, bank holidays in major economies will remove a lot of liquidity from the market.

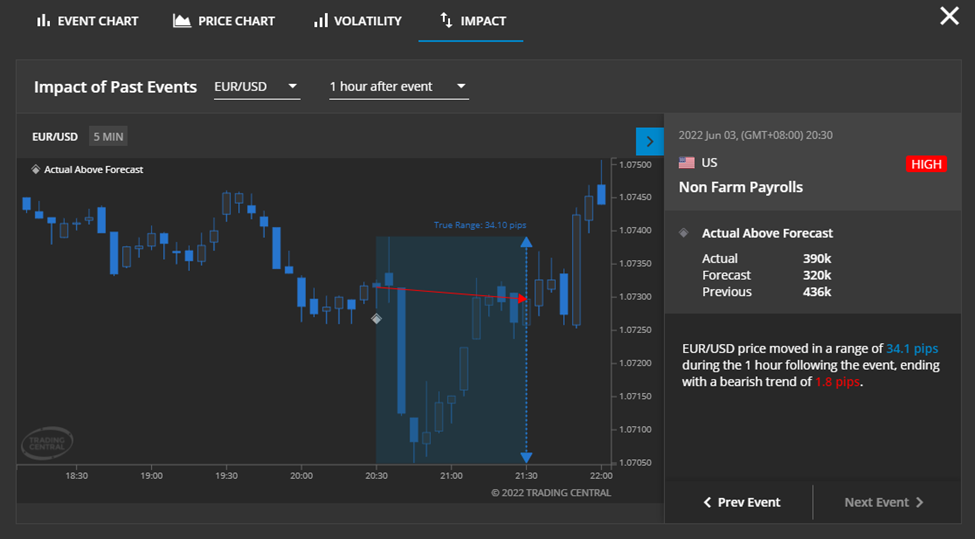

NFP last Friday was relatively slow, and Economic Insight from Trading Central provides key information in a sleek-looking illustration.

Trading Central: Economic Insight

From the chart, we can observe that EURUSD went down slightly and quickly bounced back up to end its one-hour movement just 1.8 pips below the opening price.

Precious Metals

Gold

XAUUSD Daily Chart

Most of the technical formation has not changed for gold since last Friday. Similar to EURUSD, we are expecting little movements on this metal today while everyone is getting set on US inflationary data. The broken trendline acts as immediate resistance while the 200 DMA supports gold from below.

Energies

Crude Oil

US Crude Daily Chart

Oil prices jumped last Friday to end the week at +4.57%. It could be attributed to the hike in crude price by Saudi Arabia starting with its July sales, at $6.50 premium. This move came after OPEC+ decided to accelerate their increase in output in the next months, which shows just how tight the current supply in the market is. We are definitely looking forward to crude oil hitting $129 previous highs if this continues.

US Stocks

SP500

SP500 Daily Chart

After bouncing off from the bearish trendline, SP500 managed to stay and trade above 4100. The 50 DMA is the first test for the bulls should the stock markets is to rebound from its 1-year-low. CPI remains the key event for the US stocks market so trade cautiously while the market is setting up for the event.

Cryptocurrencies

Bitcoin

BTCUSD Daily Chart

Market-leading Bitcoin has been stuck in the 30000 area for almost a month now. There was some buying taking place as we saw a 4.76% gain since today’s morning. Still no significant movement to signal any potential trending move. 34000 together with the 50 Daily moving average remain the next resistance while 30000 is a tough support level to break through.

Welf

Trader, Technical Analyst

________________________________________________________________________________________

Don’t miss out on BIG market moves!

Want to trade more than 300+ instruments with raw spreads starting from 0 pip and commissions as low as $2 per lot per side?

Sign up with FXPIG now!

Economic calendar

- Bank holiday in the UK

- NFP

Interesting Trade Ideas

Apple’s to have the first death cross in 3 and a half years. Usually stock tumbles as the 50 moving average crosses over the 200 moving average to the downside on the daily timeframe. Fundamentals-wise, apple’s annual WWDC is happening in 3 days and that could add more trading volume and volatility to the stock.

NASDAQ: AAPL Daily Chart

The probability of this death cross playing out is relatively low due to WWDC as the announcement of new exciting stuff is more than likely to push stock prices higher.

$157 will be the first resistance and then there are the 2 moving averages standing in the way.

Before the News

XAUUSD

XAUUSD Daily Chart

Gold is still stuck in between the bullish trendline and 1855 support as we wait for the job print. The number is predicted to be 325k, compared to the previous reading of 428k. However, inflationary concerns and the Russian war still overshadow the jobs market currently.

If gold breaks and closes above the trendline, we may see gold continue to rise and subsequently test 1915, the next resistance level.

Energies

US Crude

USOIL Daily Chart

Crude oil made a weekly high at $120 per barrel. Currently trading at 115.50, let’s see if it can end the week above the $115 key level as OPEC+ agreed to increase their production in the coming months. It is doubtful that the rise in production will ever be enough to cover the loss of Russian oil and when China’s slowly resuming its oil imports, the tightness in the oil markets is going to be reflected in its price. A test of its recent high at $129 is still on the table.

Welf

Trader, Technical Analyst

________________________________________________________________________________________

Don’t miss out on BIG market moves!

Want to trade more than 300+ instruments with raw spreads starting from 0 pip and commissions as low as $2 per lot per side?

Sign up with FXPIG now!

Economic calendar

Wednesday – New Zealand official cash rate/ FOMC meeting minutes

Forex

EURUSD

EURUSD Daily Chart. Source: TradingView

The Euro strengthened against the greenback over the past 10 days and is just dancing on the 1.0600 level as we speak. 1.0650 will act as the immediate resistance standing in the way of the bulls while the 50 Moving average will be the next layer of resistance to the upside.

Gold

XAUUSD

XAUUSD Daily Chart. Source: TradingView

Gold climbed steadily last week after bouncing from 1785 support and is currently testing the 1855 trendline and resistance level. The rise could be due to the USD having a slight pullback in strength as we witnessed on the EURUSD also. If it breaks above the trendline again, we could see the bullish momentum resumes, although it is not as lucrative to hold gold considering the rising interest rates.

Energies

USOIL

USOIL Daily Chart. Source: TradingView

Crude oil was trading consistently in the upper half of its trading range with the 50 daily moving average acting as support. The driving season is also about to begin in the US, which is the peak season for oil demand. Shanghai is also due to reopen its city on June 1st. The outlook for crude oil remains bullish as demand is resuming sooner or later while supply is still tight. 115 will be the first resistance to break through and we will see from there.

Stocks

SP500

SP500 Daily Chart. Source: TradingView

From a technical standpoint, SP500 has been making lower highs and lower lows, Considering the rate of decline has been increasing ( the slope of the downfall has become steeper ), the next possible target could be 3750.

Cryptocurrencies

BTCUSD

BTCUSD Daily Chart. Source: TradingView

Bitcoin has been stuck in a tight range at around 30000 key areas for quite some time now. We are still waiting for the next market catalyst and there is no directional bias for now.

Welf

Trader, Technical Analyst

Don’t miss out on BIG market moves!

Sign up for an account at FXPIG now to trade more than 300 instruments, including 60+ Crypto CFDs, 24/7 with spreads as low as 1 cent!

Economic Calendar

Monday- UK Monetary Policy Report Hearing

Wednesday- Fed Chair Powell speaks, UK CPI, Canadian CPI

Saturday- Australia election

EURUSD

EURUSD Weekly Chart. Source: TradingView

If we take a step back and look at the weekly chart on EURUSD, we can see that parity is not so far away. It is currently just sitting on 1.0350 support and if it breaks, there is not much support for the Euro. If Euro continues to depreciate against the dollar at the same rate during the past 3 months, we can expect the pair to reach parity in 2 to 3 weeks’ time

Metals

XAUUSD

XAUUSD Daily Chart. Source: TradingView

Gold has broken below the 1800 key level and it is approaching 1785 at an aggressive pace. 1785 might be the last major support before it enters a free fall area, until 1680 at the lower end of the range. The fall in gold price may be primarily due to rising interest rates, and the increased opportunity cost to hold gold instead of other higher-yielding assets.

Energies

Crude Oil

Crude Oil Daily Chart. Source: TradingView

Crude oil continued to rise and ended the previous week at almost breakeven. Trading above the $105 pivot and 50 daily moving average acting as dynamic support, it is more likely for Crude oil to rise more, with the next immediate target at $115.

Cryptocurrency

BTCUSD

BTCUSD Weekly Chart. Source: TradingView

The largest cryptocurrency by market capitalization, Bitcoin, is starting the week in the red. It is currently down 5.7%, trading just below $30000. Capital is fleeing from risk assets like Bitcoin because of global uncertainties including inflationary concerns, China’s covid situation, and Ukraine Russia war just to name a few. Bitcoin is also following a similar path with a significant positive correlation to traditional stocks, losing its appeal as a means for portfolio diversification.

Stocks Markets

SP500

SP500 Daily Chart. Source: TradingView

There was a slight recovery during last Friday’s trading, but it couldn’t close past 4050 resistance. If there is a continuation to the downside, which is more likely the case considering the solid bearish momentum since April, we are looking at 3860 being broken and SP500 heading straight to 3750.

Welf

Trader, Technical Analyst

Don’t miss out on BIG market moves!

Sign up for an account at FXPIG now to trade more than 300 instruments, including 60+ Crypto CFDs, 24/7 with spreads as low as 1 cent!

There are no important economic events to end the week, however, volatility remains high across the market with participants continuously monitoring global macroeconomic developments, from the ongoing Russian war, China’s lockdown, EU’s oil embargo to the buffed-up USD and the most recent crash in Luna and Terra.

XAUUSD

XAUUSD H4 Chart. Source: TradingView

Gold is now down to its pre-war levels, trading at $1820ish after breaking through two recent support levels with ease. While gold is traditionally negatively correlated with the stocks market, they have been moving in tandem with each other for the past 2 months.

If the price continues to breach the current support, we may be looking at 1790 areas for a potential rebound.

Image: Movement of XAUUSD relatively to SP500 (March 15 – May 13)

Source: TradingView

EURUSD

EURUSD Daily Chart. Source: TradingView

Trading at a 5-year-low, the Euro is at its weakest against the US dollar. It is trading at the 1.04 key level right now, and we are just waiting on the sidelines and see if the support holds. It is a Friday, so a significant breakout might be less likely, also there are no significant economic releases to give the price a solid push.

Crude Oil

USOIL H4 Chart. Source: TradingView

Oil is trading back above its range’s midpoint, above $105 per barrel. It is pretty much range-bound right now where supply concerns caused by war and an impending embargo are offset by reduced demand from the major oil importer- China due to its lockdown. We need to see oil prices break above $105 to signal a continuation of the bull market, and a break below $94 for further downside. However, the former is more likely to happen as lockdowns related factors can be solved more easily than a limited global oil supply.

Nasdaq

Nasdaq Daily Chart. Source: TradingView

Tech-heavy Nasdaq composite index has seen a major retracement, losing almost one-fifth of its value in its most recent downswing.

It has also broken through key support at 12250, and if we see bears continue to be in control, 11000 will be our next target level. Most of this bearish momentum was most likely caused by inflationary concerns and the implementation of tight monetary policy by the Fed.

Cryptocurrencies

BTCUSD

BTCUSD Weekly Chart. Source: TradingView

We have witnessed a bloodbath across the crypto market in the past few days.

If we look at Bitcoin’s weekly chart, it lost as much as 45% of its value, although it has made some recovery. The main reason for the most recent sell-off is because Luna. one of its biggest buyers, has been forced to sell their Bitcoin holdings to support the Peg on UST, a stablecoin on the Terra blockchain.

SOLANA

SOLANA Weekly Chart. Source: TradingView

Solana is one of the biggest losers in the recent crypto market sell-off with 64% of its value lost in the past month and a half. Our team of analysts has mapped out a potential zone to buy the dip at the $20 level. It is the price where Solana was first listed on major exchanges, and it could be a good bargain and a great chance to get your hands on some Solanas.

Welf

Trader, Technical Analyst

Don’t miss out on BIG market moves!

Sign up for an account at FXPIG now to trade more than 300 instruments, including 60+ Crypto CFDs, 24/7 with spreads as low as 1 cent!

Economic calendar

Wednesday– OPEC meeting, USD CPI

Thursday– USD PPI

The main economic event for the week will be the US inflation data, coming out at 8:30 AM EST on Wednesday.

According to Trading Central’s Economic Insight, the Core inflation is expected to slow down to 6.2% versus the previous print of 6.5%, easing inflationary concerns as the Fed continues to raise interest rates

EURUSD

EURUSD Daily Chart. Source: Tradingview

EURUSD traded lower during the early Asian session and is now testing the 1.0500 key level again. Sentiment remains bearish with 1.0650 acting as the first resistance and a short-term target at 1.0350.

XAUUSD

XAUUSD H4 Chart. Source: Tradingview

NFP came out slightly better than forecast with a print of 428k versus 390k and there weren’t much directional movements in gold following the release. Its outlook remains bearish where the trendline is still intact and the price is trading below both moving averages. 1850 will be the next key level that we are looking at should gold continues to trade lower as we wait for European’s trading volume to kick in. In the meantime, higher interest rates is keeping gold prices in check.

Crude Oil

Crude Oil Daily. Source: Tradingview

Crude oil slips as investors are concerned about weakening oil demand due to a global recession fear. Lockdowns in China certainly did not help while Aramco cut its oil prices from record highs for Asia. From a technical perspective, a bullish trendline together with $105 and 50 daily moving average will be the first line of support for oil prices. We are eyeing for the upcoming embargo on Russian oil by the EU which could push prices up.

US Stocks markets

SP500 Daily. Source: Tradingview

USTEC Daily. Source: Tradingview

SP500 closed down 0.57% while Nasdaq fell 1.84% to end the previous trading week, following market reactions to a raise in US interest rates and better than expected job numbers.

Considering the strong bearish momentum of the stocks markets (SP500 closed the past 5 consecutive weeks in loss), SP500 is most likely testing 4000 key level this week while Nasdaq may see some reaction at the 12300 level.

Cryptocurrencies

BTCUSD Daily. Source: Tradingview

Finally, there are some solid moves in Bitcoin, although it is not good news for the bulls. It dropped more than 15% in the past 5 days and is currently trading sub $35k. The next big level to watch out for is $30k and we expect some higher than usual volatility there as it is a major area.

BreadMaker

Trader, Technical Analyst

Sign up at FXPIG now and trade with raw spreads starting from 0 pip and commissions as low as $2 per lot per side!

As Expected

The short-term interest rates have been raised 50 basis points to a target rate of 0.75%-1% during the FOMC Meeting yesterday, which is what the market was expecting. Although the news has mostly been priced in, it was still the most aggressive rate hike since 2000 as inflation levels soared through the roof and hit decades-high levels.

Global Developments

Covid-related lockdowns in China and the war between Ukraine and Russia certainly did not help. In fact, they were adding a burden to the global supply chains, which put more upward pressure on inflation, not just in the US, but we have also noticed inflation levels rising steadily in the UK and Australia for example. Australia also raised its cash rate by 25 basis points just a few days ago, the first time in more than 10 years.

Projections

In the effort to contain inflation and reverse the loose monetary policies employed during the pandemic period, the central bank stated that it will continue to raise rates throughout the year.

Not only that, but the U.S. balance sheet will also be trimmed steadily starting from next month, with $47.5 billion monthly for the period between June and September, then the rate will be sped up with $95 billion of assets being let go per month.

Impact

As interest rates continue to rise, what is the impact on the economy as a whole?

Some of the most direct impacts are going to be on businesses and consumers. Consumers now have to pay higher interest rates for mortgages, credit cards spendings, etc and there will be lesser disposable income for the consumers to spend and people start to manage their finances more carefully. Meanwhile, businesses incur a higher cost for borrowing, which would subsequently reduce business activities and investments, while also taking hits from reduced demand from consumers.

I mean, isn’t this what a hawkish Fed’s contractionary monetary policy is all about?

Trading

Since FOMC has been one of the most important, if not the most important economic news release as of late, let’s have a look at the impact of the event on EURUSD, the most heavily traded Forex pair.

Source: Trading Central Economic Insight

As you can see, the event yesterday has caused the EURUSD to have the greatest True Range in the past eight events, at 113.1 pips one hour after the event took place.

Source: Trading Central Economic Insight

EURUSD moved up 71.7 pips in an hour post-FOMC meeting, which means the dollar lost some strength relative to Euro. The details of every individual event will also be shown in the section to the right side of the chart and you can also click on “< Prev Event” to view historical events to make your backtesting life easier. Charts and data all in one place, what more can you ask for?

The next FOMC event is scheduled to be on the 14th and 15th of June and so you have plenty of time to utilize Economic Insight to carry out your market research and capitalize on the next FOMC meeting.

–

Want access to Economic Insight and many more tools from Trading Central?

Sign up now at FXPIG to get access for free!